editorial comment/note

In order to improve the thinking ability of commercial trials in Shanghai No.2 Intermediate People’s Court and the courts in its jurisdiction, improve the quality and effectiveness of commercial trials, and improve the unified mechanism of applying laws, the Commercial Court of Shanghai No.2 Intermediate People’s Court conducted a typological investigation and exploration on the application of factor-based trial methods in some commercial cases. In this issue, "Guidelines for Factor-based Trial of Equity Transfer Disputes (Trial)" was published, which was jointly written by the Commercial Court of Shanghai No.2 Intermediate People’s Court and the Commercial Court of Huangpu Court, and was discussed and passed at the meeting of professional judges of the Commercial Court of Shanghai No.2 Intermediate People’s Court, providing reference for commercial trials of courts in the jurisdiction.

Common trial elements and their review points

Equity transfer, a changes in equity based on legal acts, is a private law act in which the transferring shareholder and the transferee conclude an equity transfer contract and transfer the equity. Articles 71 to 75 of Chapter III of People’s Republic of China (PRC) Company Law (hereinafter referred to as the Company Law) make special provisions on this. Equity transfer contracts have the characteristics of general civil contracts. The general provisions on the validity of civil legal acts (invalid, undetermined and revocable) and their consequences in the General Part of People’s Republic of China (PRC) Civil Code (hereinafter referred to as the Civil Code) and the provisions on the validity of contracts in the Contract Part of the Civil Code are applicable to equity transfer contracts. The provisions on the conclusion, performance, liability for breach of contract, and dissolution of the contract in the Civil Code are also applicable to the equity transfer contract. The equity transfer contract is an unnamed contract, the subject matter of which is equity, and it is a special sales contract. According to the provisions of Articles 467 and 646 of the Civil Code, in the absence of other laws, disputes over equity transfer can be resolved by referring to the relevant provisions of applicable sales contracts. These Guidelines closely follow the right attribute of equity, and focus on the typical problems that distinguish equity transfer contracts from sales contracts, including: the relationship between state supervision and contracts, the relationship between restrictions on equity transfer by laws or articles of association, the relationship between company capital system and contracts, etc., and collect information on case elements, sort out specific review points, and use them as reference for similar cases. It should be noted that these guidelines mainly focus on the review points in the trial of disputes over equity transfer contracts.If it involves the transfer of equity as a disciplinary action, special instructions will be made. In addition, this guideline does not involve disputes over equity transfer contracts of financial institutions and share transfer contracts of listed companies.

one

Ordinary equity transfer contract

Obtaining complete equity based on equity transfer is a gradual process, which first occurs between the transferor and the transferee, then between the transferee and the company, and finally between the third party (including the transferor’s creditors, transferee’s creditors, company creditors, etc.) and the company. When the equity appears purely as a target, the contractual rights and obligations mainly involve both parties to the equity transfer. Such disputes may be more about whether the contract law is fully fulfilled or whether there are problems such as dissolution after the contract purpose cannot be achieved. The determination of the rights and obligations of both parties should follow the true meaning of the parties. Usually, after the equity transfer contract comes into effect, the main payment obligations of both parties to the equity transfer contract are that the transferor transfers the equity and the transferee pays the equity transfer money.

1. Obligations of the assignor

As for the assignor’s obligations, the reasons for the dispute between the two parties or the assignee’s defense are mainly as follows: first, the restrictions on equity transfer in the articles of association have not been observed, the consent of other shareholders has not been obtained or clearly obtained, or the preemptive right of other shareholders has not been respected. Second, the company has not completed the internal procedures, including the changes recorded in the register of shareholders, the failure to issue a capital contribution certificate, and the failure to amend the articles of association. Third, the change registration of shareholders in the company registration authority has not been completed. The main points of the review of the first point have been sorted out in part (b). Regarding the second and third points mentioned above, although there is great controversy about the changes in equity model in theory and practice, for both parties to the equity transfer contract, how to determine the transferor’s obligations and whether to complete the main payment obligations should respect the agreement of both parties and seek the true meaning. The main points of review are as follows:

① If it is stipulated in the contract that the transferor shall cooperate with the target company to complete the renewal of the investment certificate, change the records in the register of shareholders, modify the articles of association and change the company registration, the transferor shall fulfill the corresponding obligations according to the contract. If the assignor fails to perform the above obligations, the assignee may request to order the assignor to perform the corresponding obligations. If the assignor refuses to perform, the assignee may exercise the right of rescission according to law.

(2) If there is no explicit agreement in the contract, it shall be determined whether the contents agreed by both parties include that the transferor shall ensure that the transferee’s shareholder status is confirmed by the company, and whether it includes the obligation to ensure that the company completes the registration of the transferee as a shareholder. After confirming the assignor’s obligations, it is further judged whether the assignor has breached the contract or not, and whether it constitutes a fundamental breach of contract, which leads to the failure to achieve the contract purpose.

③ Unless otherwise agreed in the contract, the signing of the contract presumes that the transferor agrees to transfer the equity to the transferee, and the transferor shall inform the company of the equity transfer. If the transferor fails to inform the company of the transfer in time, the transferee may request the transferor to perform the corresponding obligations.

④ According to Article 73 of the Company Law, it is the legal obligation of the company to record the transferee in the register of shareholders, issue a capital contribution certificate, modify the shareholders’ clauses in the Articles of Association, and register the change of shareholders at the company registration authority, which is not an obligation under the equity transfer contract. If the transferor has notified the company of the equity transfer, but the company fails to complete the above changes in time, the transferee has the right to require the company to fulfill its legal obligations and claim compensation for losses.

⑤ Even if the company has not registered the change of company, if the transferee has participated in the shareholders’ meeting as a shareholder and received dividends, and there are no other special provisions in the equity transfer contract, and the transferor has not refused to cooperate, if the transferee refuses to pay the equity transfer fee just because the company has not registered the change, its claim will be difficult to support. You can explain to the transferee that you can sue the company separately.

2. Obligations of the assignee

2.1 Review points of equity transfer payment

In the equity transfer contract, the transferee’s main payment obligation is to pay the equity transfer money, and the key points of review are as follows:

① Determination of equity transfer payment. Disputes over the amount of equity transfer money mostly occur when the equity transfer contract kept by the parties and the equity transfer contract filed by the registration authority have different stipulations on equity transfer money. This kind of "yin-yang contract" is mostly caused by the parties’ tax avoidance and tax evasion. In this case, we should explore the true meaning of both parties in combination with the negotiation process, contract agreement and contract performance, and determine which contract or the price in which contract reflects the true meaning of both parties. It is forbidden for judges to determine the price by themselves according to the company’s assets and financial information, and according to the "fairness principle".

(2) On the exercise of the right of defense for simultaneous performance. If the transferee refuses to pay the equity transfer payment on the grounds that the transferor has not delivered the company license and account books, it should pay attention to examining whether the equity transfer contract has a corresponding agreement on the transferor’s obligation to deliver the company license and account books, and whether this obligation corresponds to the obligation to pay the equity transfer payment.

2.2 One party requests to confirm that the equity transfer contract is invalid or cancel the equity transfer contract because of dissatisfaction with equity transfer price.

Equity is a special "commodity". There is no unified market for the equity of a limited liability company, and its value is difficult to determine. Besides the company’s assets, the company’s cash flow is also an important factor for both parties to determine the price. For both parties to the transaction, the determination of equity transfer price is the "subjective" judgment of the commercial subject. In addition, the company’s industry and industry development will also have an impact on the equity value. In addition, changes in equity involves many links, and the parties may go back on their word during this period, which is also an important reason for the frequent disputes over equity transfer. After the signing of the equity transfer contract, if one party requests to confirm that the equity transfer contract is invalid or request to cancel the contract because of disagreement with the equity price, the main points of the review are as follows:

(1) the price factor itself is not the reason for determining that the contract is invalid. Whether the contract is invalid or not should be determined according to the relevant provisions of the Civil Code on the invalidity of legal acts.

(2) After the signing of the equity transfer contract, if one party requests to cancel the equity transfer contract on the grounds of major misunderstanding, obviously unfair, fraud, etc. because of disagreement with the equity price, it shall be reviewed according to the relevant provisions of the Civil Code on the cancellation of legal acts and combined with specific cases.

(3) If there is no such situation, the parties to the contract should not support their objections to the effectiveness of the contract just because they have objections to the equity price or the equity price changes greatly, which is the risk that the parties should bear. Even if there is a change of circumstances, it will be handled by the court at the request of the parties according to the legal provisions and specific circumstances under the premise that the equity transfer contract is valid.

3. Review of other contract disputes.

3.1 Equity transfer contract for shareholders who have not completed the capital contribution period, shareholders who have not fulfilled or fully fulfilled their capital contribution obligations, and shareholders who have withdrawn their capital contribution.

(1) The shareholders who have not completed the capital contribution period transfer their shares to the outside world, and the main points of review are as follows:

(1) Shareholders who have not completed the capital contribution period can still transfer their equity according to law, and the corresponding equity transfer contract shall be deemed valid if there are no other reasons that affect the effectiveness of the contract.

(2) The rights and obligations of the transferor and the transferee shall be determined according to the stipulations of the equity transfer contract, but the obligations of both parties to the company and its creditors shall be determined according to relevant laws. It is worth noting that at present, the Company Law and judicial interpretation do not directly stipulate the obligations of the transferor in this case, but the first paragraph of Article 88 of the Second Revised Draft of the Company Law stipulates this situation: "If a shareholder transfers the equity that has subscribed for capital contribution but has not yet paid the capital contribution period, the transferee shall bear the obligation to pay the capital contribution; If the transferee fails to pay the capital contribution in full and on time, the transferor shall bear supplementary responsibilities for the capital contribution that the transferee fails to pay on time. " In the trial practice, we should continue to pay attention to the revision of the Company Law. Before the revision of the Company Law is completed, we can handle such disputes with reference to this spirit.

(2) Shareholders who have not fulfilled or not fully fulfilled their capital contribution obligations transfer their shares to the outside world. The main points of review are as follows:

① Shareholders who fail to fulfill or fully fulfill their capital contribution obligations transfer their equity to the outside world, and the validity of the corresponding equity transfer contract is determined as above.

(2) The rights and obligations of the transferor and the transferee shall be determined according to the agreement on equity transfer. According to Article 18 of the Supreme People’s Court’s Provisions on Several Issues Concerning the Application of the Company Law of People’s Republic of China (PRC) (hereinafter referred to as Interpretation III of the Company Law), if a shareholder fails to perform or fails to fully perform his capital contribution obligations, the transferee knows or should know that the company has the right to request the shareholder to perform his capital contribution obligations and the transferee is jointly and severally liable for it, and the company’s creditors have the right to request the shareholder with capital contribution obligations to bear supplementary liability for the unpaid part of the company’s debts within the scope of principal and interest, and the transferee shall bear joint liability. Paragraph 2 of Article 88 of the Second Revised Draft of the Company Law also stipulates that "if a shareholder fails to pay the capital contribution in full on schedule or the actual price of non-monetary property as capital contribution is significantly lower than the subscribed capital contribution, if the transferee knows or should know the above situation, he shall be jointly and severally liable with the shareholder within the scope of insufficient capital contribution."

(3) Withdrawing the capital contribution shareholders to transfer their shares to the outside world, and the main points of review are as follows:

(1) If the shareholder who withdraws the capital contribution transfers the equity to the outside world, the validity of the corresponding equity transfer contract shall be determined as above.

(2) The rights and obligations of the transferor and the transferee shall be determined according to the agreement on equity transfer, but the obligations of both parties to the company and its creditors shall be determined according to relevant laws. At present, the Company Law and judicial interpretation do not directly stipulate the assignee’s obligations in this case. If the withdrawal of capital contribution is understood as an infringement of the company’s property rights, it seems that there is no legal basis for requiring the assignee to bear joint liability for the relevant responsibilities of the assignor without assisting the assignor to withdraw capital contribution. However, if the transferor withdraws the capital contribution immediately after the capital contribution, the situation is not much different from that of the non-capital contribution. If the transferee knows or should know of the above situation, it can refer to the provisions of Article 18 of Interpretation III of the Company Law.

3.2 The effectiveness of the equity transfer contract during the existence of the husband-wife relationship

This kind of cases mostly occur at the stage of divorce proceedings between husband and wife or before they are ready to file divorce proceedings. Plaintiffs usually regard the equity as the common property of husband and wife, and take their spouses and equity transferees as defendants on the grounds that their spouses and equity transferees are not approved by the plaintiff, that is, both parties to the equity transfer contract are told to the court and request to confirm that the equity transfer contract is invalid. Key points for review of such cases:

(1) the equity acquired during the marriage relationship or the equity invested by the husband and wife’s joint property is not necessarily the joint equity of the husband and wife. The ownership of equity and the determination of shareholders’ qualifications should be determined according to the articles of association, the register of shareholders and the company registration.

② Shareholders have the right to dispose of foreign transfer of equity without the consent of their spouses.

③ The corresponding equity transfer contract shall be deemed valid if there are no other reasons that affect the effectiveness of the contract.

3.3 Equity transfer contract for nominal shareholders to transfer equity under the condition of holding equity on behalf of others.

Article 25 of Interpretation III of the Company Law stipulates, "If a nominal shareholder transfers, pledges or disposes of the equity registered in his name, and the actual investor requests that the disposition of the equity is invalid on the grounds that he has actual rights over the equity, the people’s court may refer to the provisions of Article 311 of the Civil Code. If the nominal shareholder disposes of the equity and causes the actual investor to lose money, and the actual investor requests the nominal shareholder to bear the liability for compensation, the people’s court shall support it. " In practice, stock holding can be divided into two situations: complete anonymity and incomplete anonymity. The main points of review are as follows:

(1) completely anonymous. In this case, for the company, other shareholders and the transferee, the investor is a shareholder and cannot be called a "nominal shareholder". The investor has the right to dispose of the equity transfer, and the equity transfer contract is valid. changes in equity is no different from ordinary equity transfer, so there is no room for the application of Article 25 of Interpretation III of the Company Law.

② Incomplete anonymity. In this case, within the company, all other shareholders admit that the actual investor is a shareholder, and the nominal shareholder is not a shareholder in essence. Therefore, the nominal shareholder’s unauthorized transfer of equity constitutes no right to dispose of it. In this case, as a burden, the equity transfer contract shall be deemed valid unless there are other circumstances that affect the effectiveness of the contract. For the effectiveness of punishment, we can refer to the provisions of Article 311th of the Civil Code on bona fide acquisition.

two

Restrictions on equity transfer by laws or articles of association and equity transfer contract

The object of the equity transfer contract is equity, and equity, as a right facing the company organization, should be adjusted by the relevant legal norms of the company organization in the Company Law. The restrictions on equity transfer in the Company Law and other laws or articles of association will inevitably have an impact on the equity transfer contract.

1. The preemptive right of other shareholders and the equity transfer contract

1.1 Shareholders’ preemptive right

1.1.1 "Company Law" on the provisions of shareholders’ preemptive right

The Company Law restricts the equity transfer of a limited liability company. If the transferring shareholder transfers the equity to the outside world, other shareholders shall enjoy the preemptive right under the same conditions.

In view of the fact that the exercise of the preemptive right of other shareholders and the remedies after the preemptive right is infringed will have an impact on the equity transfer contract, it is necessary to sort out the main points of the review of the exercise of the preemptive right of shareholders first:

(1) The subject and conditions for exercising the preemptive right. According to the second paragraph of Article 71 of the Company Law, specifically:

① Other shareholders in a limited liability company except the transferring shareholder.

(2) transfer shareholders to transfer equity to people other than shareholders.

③ Where there are other provisions in the articles of association on equity transfer, such provisions shall prevail.

(2) The consent right of other shareholders (first notice). According to the provisions of Paragraph 2 of Article 71 of the Company Law and Paragraph 1 of Article 17 and Article 22 of Interpretation 4 of the Company Law, shareholders of a limited liability company shall notify other shareholders when transferring their equity to persons other than shareholders, specifically:

(1) notification method. The transferring shareholder may be notified in writing or in other reasonable ways to ensure knowledge. According to the provisions of Article 137 of the Civil Code, the notice shall come into effect when other shareholders know its contents. If it is made in a non-dialogue way, it will take effect when it reaches other shareholders; If the non-dialogue notice is in the form of data message, if other shareholders designate a specific system to receive the data message, the data message will take effect when it enters the specific system; if no specific system is designated, other shareholders know or should know that the data message will take effect when it enters its system. The notification obligor shall be the transferring shareholder.

② Where the equity is transferred to a person other than the shareholders through auction, the method of "written notice" and "notice" shall be determined according to the legal provisions in Item ① above and the laws and regulations related to auction. When transferring state-owned shares in a legally established property rights exchange, the way of "written notice" and "notice" can refer to the trading rules of the property rights exchange.

③ Proportion of agreed transfer. It must be agreed by more than half of other shareholders, which is determined by "number of shareholders" here, not by voting rights, and the company is not allowed to relax the conditions of consent in its articles of association.

(4) the period of consent and the change of disagreement and consent. Other shareholders shall reply within 30 days from the date of receiving the written notice. If they fail to reply, they shall be deemed to have agreed to the transfer. Shareholders who do not agree to the transfer shall purchase the transferred equity; Do not buy, as agreed to transfer.

(3) The preemptive right of other shareholders (second notice). According to the provisions of Paragraph 3 of Article 71 of the Company Law and Paragraph 2 and Paragraph 3 of Article 17 of Interpretation 4 of the Company Law, Article 18, Article 19 and Article 22, other shareholders may exercise the preemptive right under the same conditions:

(1) the way of notification. Shareholders may notify in writing or in other reasonable ways to ensure knowledge.

② The same conditions. When judging whether it meets the "equal conditions", we should consider the quantity, price, payment method and time limit of the transferred equity. The same conditions are not limited to specific fixed factors, as long as all kinds of factors that are reasonably valued by the transferor and can have a substantial impact on the transaction are listed here, such as the obligation of subordinate payment that cannot be replaced or can not be valued by money, the commitment to employee placement, the commitment to debt commitment, equity swap, etc.

(3) Where the equity is transferred to a person other than a shareholder by auction, the "written notice", "notice" and the determination of "equivalent conditions" shall be determined according to relevant laws and judicial interpretations. When transferring state-owned shares in a legally established property rights exchange, the methods of "written notice" and "notice" and the determination of "equivalent conditions" can refer to the trading rules of the property rights exchange.

(4) other shareholders exercise their rights within a reasonable period of time. Shareholders who claim the priority to purchase the transferred equity shall, after receiving the notice, make a purchase request within the exercise period stipulated in the articles of association. If the exercise period is not specified in the Articles of Association or is unclear, the period specified in the notice shall prevail; if the period specified in the notice is shorter than 30 days or the exercise period is unclear, the exercise period shall be 30 days.

(4) Two-in-one notification procedure. In practice, after the transferring shareholder and the potential transferee negotiate the terms of the contract or the basic transaction conditions, the two notices are merged into one notice, which should also be deemed to be in compliance with the relevant provisions of the law. If other shareholders are willing to accept the contract on the same terms, both parties can directly conclude the contract. We should also pay attention to the relevant provisions of the revised company law. At present, Article 84 of the Revised Draft of the Company Law only stipulates one notice, that is, "if a shareholder transfers his equity to a person other than a shareholder, he shall notify other shareholders in writing, and other shareholders shall have the preemptive right under the same conditions".

(5) Transfer the shareholders’ right of estoppel. According to Article 20 of Interpretation 4 of the Company Law, the transferring shareholder has the right to go back on his word:

(1) Unless otherwise stipulated in the Articles of Association, if the transferring shareholder does not agree to transfer the equity after other shareholders claim the preemptive right, the claim of preemptive right of other shareholders shall not be supported.

(2) the right of estoppel shall not be abused.

③ If the transferring shareholder goes back on his word, other shareholders may claim that the transferring shareholder should compensate his reasonable losses.

(6) Remedies for infringement of preemptive right. According to Article 21 of Interpretation 4 of the Company Law, the remedies for infringement of preemptive right include claiming priority and damages, as follows:

(1) advocate the realization of preemptive right. Where the transferring shareholder fails to seek the opinions of other shareholders on the transfer of its equity, or damages the preemptive right of other shareholders by means of fraud or malicious collusion, other shareholders may claim to purchase the transferred equity under the same conditions, but they shall do so within 30 days from the date when they know or should know the same conditions for exercising the preemptive right, except that more than one year has passed since the date of registration of equity change. These "30 days" and "one year" are the same period, and the provisions of suspension, interruption and extension are not applicable.

(2) claim damages. If the infringed shareholder is unable to exercise the preemptive right for reasons other than his own, he may claim damages.

(3) Other shareholders only request to confirm the equity transfer contract and the validity of changes in equity, and do not advocate to purchase the transferred equity under the same conditions at the same time, so their application shall not be supported, except that other shareholders cannot exercise the preemptive right due to their own reasons, and claim damages.

1.1.2 Special Provisions on Shareholders’ Right of Consent and Preemptive Right of Foreign-invested Enterprises

Articles 11 and 12 of the Provisions of the Supreme People’s Court on Several Issues Concerning the Trial of Disputes in Foreign-invested Enterprises (I) stipulate the validity of the equity transfer contract when the shareholders’ consent rights and preemptive rights of foreign-invested enterprises are infringed, which is different from the relevant provisions of the Company Law of People’s Republic of China (PRC) (hereinafter referred to as the Company Law) and the Provisions of the Supreme People’s Court on Several Issues Concerning the Application of the Company Law of People’s Republic of China (PRC) (IV) (hereinafter referred to as the Company Law Interpretation IV), and should be paid attention to.

① If a shareholder of a foreign-invested enterprise transfers all or part of its equity to a third party other than the shareholder, it shall be unanimously agreed by other shareholders, who have the right to request cancellation of the equity transfer contract on the grounds that they have not obtained their consent. Exceptions: firstly, there is evidence that other shareholders have agreed; secondly, the transferor has given a written notice on the transfer of equity, and other shareholders have not given a reply within 30 days from the date of receiving the written notice; thirdly, other shareholders do not agree to the transfer and do not buy the transferred equity.

② If a shareholder of a foreign-invested enterprise transfers all or part of its equity to a third party other than the shareholder, other shareholders have the right to request cancellation of the equity transfer contract on the grounds that the equity transfer infringes on their preemptive right. Unless other shareholders know or should know that they have not claimed the preemptive right within one year from the date of signing the equity transfer contract.

(3) If the transferor or transferee requests that the equity transfer contract is invalid on the grounds of infringing the preemptive right of other shareholders, it shall not be supported.

1.2 Infringe on the preemptive right of other shareholders and the performance of the equity transfer contract

The exercise of the shareholders’ preemptive right and the remedies after the infringement of the preemptive right are often related to the performance of the equity transfer contract between the transferring shareholders and the transferee. If the shareholders’ preemptive right is infringed, they can claim to exercise the preemptive right, but the equity transfer contract between the transferring shareholders and the transferee cannot be continued. If the shareholders’ preemptive right is infringed, they can only claim damages, and the equity transfer contract between the transferring shareholders and the transferee may not be affected. According to the contents of Article 9 of the Minutes of the Ninth People’s Congress, the specific review points are as follows:

① The equity transfer contract between the transferring shareholder and the transferee shall be deemed valid if there are no other reasons that affect the effectiveness of the contract.

② The exercise of preemptive right by other shareholders only leads to the transferee’s inability to request the transferring shareholder to continue to perform the equity transfer contract, that is, it only affects the punishment behavior. Although the transferee other than the shareholder’s request to continue to perform the equity transfer contract cannot be supported, it does not affect its request to the transferring shareholder to bear the corresponding liability for breach of contract, and it can also request to terminate the contract on the grounds that the contract purpose cannot be achieved.

(3) Even if the transferring shareholder has completed the company change registration without notifying other shareholders after signing the equity transfer contract with the transferee, it should be recognized that the equity transfer contract between the transferring shareholder and the transferee implies the following obligations, that is, when other shareholders exercise the preemptive right according to law, the transferee should cooperate to re-transfer the equity to the transferring shareholder, including cooperating to handle the corresponding change registration.

2. Equity transfer contract under the condition that the company’s articles of association restrict equity transfer.

Based on the closeness and humanity of a limited liability company, Article 71 of the Company Law stipulates that "if there are other provisions on equity transfer in the articles of association, those provisions shall prevail". If the restrictions on equity transfer in the articles of association are not invalid, the effectiveness and performance of the equity transfer contract that violates the restrictions on equity transfer in the articles of association may cause disputes among the parties. The main points of review are as follows:

① The Articles of Association is an agreement on internal autonomy of the company, not a mandatory provision of laws and regulations. Violation of the Articles of Association does not necessarily lead to the invalidity of the equity transfer contract. If there are no other reasons that affect the effectiveness of the contract, it shall be deemed valid.

(2) If the equity transfer violates the company’s articles of association, so that the transferee cannot obtain the equity, the transferee may claim the liability for breach of contract from the transferring shareholder, or terminate the contract on the grounds that the purpose of the contract cannot be achieved.

③ If the transferee is aware of the relevant restrictions in the Articles of Association when signing the contract, the corresponding losses shall be borne by him.

3. Share transfer contracts that violate legal restrictions.

The shares held by the shareholders of a joint-stock company can be transferred according to law. However, for the shareholders with special status and Dong Jiangao, Article 141 of the Company Law still has certain restrictions on their share transfer. The effectiveness and performance of the equity transfer contract that violates the legal restrictions may cause disputes among the parties. The key points of the case review are as follows:

3.1 In view of the restrictions on the transfer of shares by promoters in the Company Law,

① The shares of the Company held by the promoters shall not be transferred within one year from the date of establishment of the Company. In addition, the shares issued before the company’s public offering of shares shall not be transferred within one year from the date when the company’s shares are listed and traded on the stock exchange.

(2) If the promoters transfer shares within the restricted period stipulated by law, if the equity transfer contract is a contract with a term or conditions, it shall be deemed valid if there are no other reasons that affect the effectiveness of the contract. Both parties have the right to request the other party to perform the contract according to the contract from the date when the term expires or the conditions are fulfilled.

(3) When the promoters transfer their shares within the restricted sale period stipulated by law, they may determine that the disciplinary action is invalid if the contract is deemed to be valid. The transferee should be aware of the relevant legal restrictions before signing the contract, and the corresponding losses should be borne by himself. The signing of the share transfer agreement between the sponsor and the transferee does not exempt them from their legal responsibilities, including the obligations of the sponsor as a shareholder of the company.

3.2 In view of the restrictions imposed by the Company Law on directors, supervisors and senior managers,

① During his term of office, the company’s Dong Jiangao shall not transfer more than 25% of the total shares of the company he holds, and the shares of the company he holds shall not be transferred within one year from the date of listing and trading of the company’s shares. Within six months after leaving his post, he shall not transfer his shares in the Company.

② The review points of the effectiveness of share transfer contract and liability for breach of contract are the same as 3.1.

three

State supervision and equity transfer contract

In the trial of equity transfer disputes, we should first pay attention to the effectiveness of the contract, and state supervision has an important impact on the effectiveness and performance of the contract.

1. State supervision and effectiveness of equity transfer contract

1.1 Equity transfer of state-owned enterprises

The transfer of state-owned shares shall follow the principles of equal compensation, openness, fairness and justice, so as to prevent the loss of state-owned assets and damage the legitimate rights and interests of all parties to the transaction. Articles 51 to 57 of the State-owned Assets Transfer Part of Section V of the State-owned Assets Law of People’s Republic of China (PRC) Municipality make relevant provisions on the approval, evaluation and trading place of the equity transfer of state-owned holding and shareholding companies.

(1) The influence of the approval procedure on the equity transfer contract of state-owned enterprises. Attention should be paid to whether the equity transfer of state-owned enterprises should be approved, and the main points of the review are as follows:

(1) if the relevant approval procedures affect the effectiveness of the contract without approval, according to the provisions of Article 502 of the Civil Code, the contract shall be deemed to be ineffective without approval. If the parties request to confirm that the contract is invalid on this ground, it will not be supported.

② If the aforesaid equity transfer contract is deemed to be ineffective because it has not been approved, it will not affect the effectiveness of the clauses in the contract in which the parties perform the obligation of approval and the relevant clauses set due to the obligation of approval.

(3) If the relevant approval procedures do not affect the effectiveness of the contract and are not approved, it will only affect the effectiveness of disciplinary actions or have adverse consequences in administrative supervision according to relevant laws and regulations. If there are no other reasons that affect the effectiveness of the contract, the equity transfer contract shall be deemed to be valid.

Specifically, according to the provisions of Article 25 of the Interim Measures for the Administration of the Transfer of State-owned Property Rights of Enterprises, if the transfer of state-owned property rights of enterprises causes the state to lose its holding position, it shall be reported to the people’s government at the same level for approval. According to the provisions of Article 26, the invested enterprise shall report to the state-owned assets supervision and administration institution at the same level for countersigning with the financial department for approval when deciding on the transfer of major state-owned property rights of its important subsidiaries. If it involves the examination and approval of the government’s social and public management, it shall be reported to the relevant government departments for examination and approval in advance. According to the provisions of Article 32, if the above approval procedures are not fulfilled, the state-owned assets supervision and administration institution or the relevant approval institution for the transfer of state-owned property rights of enterprises shall require the transferor to terminate the transfer of property rights, and if necessary, bring a lawsuit to the people’s court according to law to confirm that the transfer is invalid. Accordingly, if the above situation is not approved, the relevant equity transfer contract will not take effect. Therefore, for the equity transfer of state-owned enterprises, attention should be paid to examining whether there are the above situations or other situations stipulated by law that require the approval of the party to take effect.

(2) Other circumstances that affect the effectiveness of the contract. According to the provisions of Article 32 of the Interim Measures for the Administration of the Transfer of State-owned Property Rights of Enterprises, in the process of the transfer of state-owned shares, the state-owned assets supervision and administration institution or the relevant approval institution for the transfer of state-owned property rights of enterprises shall require the transferor to terminate the transfer of property rights, and if necessary, bring a lawsuit to the people’s court according to law to confirm that the transfer is invalid. In case that the violation of the relevant provisions of the State-owned Assets Law of People’s Republic of China (PRC) on evaluation and trading places causes damage to the national interests, it belongs to the case that the provisions of Article 153 of the Civil Code violate the mandatory provisions of the law, and the relevant contracts shall be deemed invalid. The main points of the review are as follows:

(1) for the transfer of state-owned shares, attention should be paid to whether the review and evaluation procedures conform to the provisions of the Law of People’s Republic of China (PRC) on State-owned Assets of Enterprises.

(2) For the transfer of state-owned shares, attention should be paid to examining whether the trading place complies with the provisions of the Law of People’s Republic of China (PRC) on State-owned Assets of Enterprises.

1.2 Equity transfer of foreign investment

(1) The influence of the approval procedure on the equity transfer contract with foreign investment. According to the provisions of the Supreme People’s Court Municipality on Several Issues Concerning the Trial of Dispute Cases of Foreign-invested Enterprises (I), the main points of the review are as follows:

(1) If the equity transfer contract with foreign investment shall come into effect after being approved by the examination and approval authorities of foreign-invested enterprises according to laws and regulations, it shall come into effect as of the date of approval. Without approval, it shall be deemed that the contract has not come into effect. If the parties request to confirm that the contract is invalid on this ground, it will not be supported.

(2) If the equity transfer contract is deemed to be ineffective because it has not been approved, it will not affect the effectiveness of the clauses in the contract that the parties perform the obligation of approval and the relevant clauses set due to the obligation of approval.

(3) If the supplementary agreement reached by the parties on matters related to foreign-invested enterprises does not constitute a major or substantial change to the approved contract, it shall not be deemed that the supplementary agreement has not taken effect on the grounds that it has not been approved by the examination and approval authority of foreign-invested enterprises. "Major or substantial changes" include: changes in registered capital, company type, business scope, business term, capital contribution subscribed by shareholders, capital contribution mode, company merger, company division and equity transfer.

(2) The influence of negative list on the effectiveness of foreign-invested equity transfer contract. Article 28 of Chapter IV Investment Management of the Foreign Investment Law of People’s Republic of China (PRC) deals with the provisions on equity transfer of foreign-invested enterprises, that is, foreign investors are not allowed to invest in the areas prohibited by the negative list of foreign investment access, and the areas restricted by the negative list of foreign investment access, and foreign investors should meet the conditions stipulated by the negative list when investing. Foreign investment in areas outside the negative list shall be managed in accordance with the principle of consistency between domestic and foreign investment. Articles 2 to 5 of the Supreme People’s Court’s Interpretation on Several Issues Concerning the Application of the Foreign Investment Law of People’s Republic of China (PRC) further clarify the influence of foreign investment-related agreements, including equity transfer contracts, according to the above provisions. The main points of review are as follows:

① Investment contracts formed in areas other than the negative list of foreign investment access need not be approved or registered.

② In the negative list, the relevant equity transfer contract in the field of prohibited investment is invalid.

③ In the field where the negative list restricts investment, the parties concerned do not meet the special management measures for restricted access, and the relevant equity transfer contract is invalid.

Matters needing attention in the trial:

① Before the effective judgment is made, the equity transfer contract is valid if the investment is prohibited or restricted from moving out of the negative list.

② If the relevant contracts were signed before the implementation of the Foreign Investment Law (January 1, 2021), and the dispute over the equity transfer contract is still in the first and second trial proceedings, the new provisions shall apply.

(3) The above provisions shall apply with reference to disputes over equity transfer related to investments in the Mainland by investors from Hong Kong, Macao and Taiwan and China citizens who have settled abroad.

2. Breach and dissolution of the equity transfer contract that fails to fulfill the obligation of approval

The equity transfer contract that must be approved by the administrative organ and come into effect, the agreement related to the obligation of approval comes into effect independently, and the breach and dissolution of such contracts are different from other equity transfer contracts that are all in effect. According to the provisions of Article 502 of the Civil Code and the contents of Articles 38, 39 and 40 of the Minutes of Civil and Commercial Trials of National Courts (hereinafter referred to as Minutes of the Ninth People’s Congress) issued in 2019, the specific review points are as follows:

(1) review of the obligation of approval and relevant breach clauses.

(1) the contract that needs to be approved by the administrative organ to take effect, if there is a special agreement on the obligation of approval and the liability for breach of contract that fails to fulfill the obligation of approval, the agreement will take effect independently.

(2) because the other party fails to perform the obligation of approval, one party has the right to request the termination of the contract and ask it to bear the corresponding liability for breach of contract stipulated in the contract.

(3) The party who undertakes the obligation of approval shall not refuse to perform the obligation of approval on the grounds that the contract has not come into effect, otherwise the other party may go through the relevant formalities by himself and claim damages for the expenses or actual losses arising therefrom.

(2) Interpretation of the obligation of approval

① If one party requests the other party to perform the main rights and obligations of the contract, it shall explain to him that the application should be changed to request to perform the obligation of approval. If a party changes the claim, it shall be supported.

(2) If the party refuses to change the claim after the explanation, it shall reject its claim, but it shall not affect it to file another lawsuit.

(3) review of the handling after the judgment has fulfilled the obligation of approval.

(1) after the court ruled that one party performed the obligation of approval, the party refused to perform it, and the other party has the right to request it to bear the liability for breach of contract after compulsory execution.

(2) one party shall perform the obligation of approval according to the judgment, and the administrative organ shall approve it, and the contract shall have full legal effect, and it shall have the right to request the other party to perform the contract. Without the approval of the administrative organ, the contract is not legally enforceable, and one party has the right to request the termination of the contract.

four

Equity transfer contract involving the transfer of company control rights and assets.

1. Equity transfer contract involving the transfer of control rights of the company

If the purpose of the equity transfer contract is for the transferee to obtain the control right of the target company, the examination elements of the transferor’s obligations, the corresponding liability for breach of contract and the termination of the contract are different from the above-mentioned ordinary equity transfer contract. While applying the relevant provisions of the Civil Code, we cannot ignore the relevant regulations of the Company Law on company organization and corporate governance.

For the equity transfer contract involving the transfer of control rights of the company, the contract usually includes the following contents: the transferor shall complete the delivery or handover of various financial documents, legal documents, company seals, business licenses, customer information, technical secret information and even personnel in the company; Distribution requirements of corporate governance power, such as re-election of the board of directors or quota allocation, and change of legal representative; The disclosure of the debts of the target company and the relevant commitments and guarantee clauses.

To some extent, this kind of contract dispute is not a simple transaction contract, but has the attribute of organization contract. The main points of review are as follows:

① Whether the agreement of the equity transfer contract conflicts with the relevant provisions of the Company Law and the articles of association.

(2) The obligations of the transferor of such contracts are not limited to notifying the company and assisting in handling all kinds of changes, but may also include ensuring that the company completes the corresponding change registration, as well as other contractual obligations such as license, transfer of financial information, and ensuring the re-election of the board of directors. The assignor’s failure to perform the agreed obligations constitutes a breach of contract. For the termination of the contract, the purpose of the contract should be determined by combining the transaction background and contract content of both parties, and then it should be determined whether the contract purpose can not be realized if the assignor fails to perform according to the contract.

(3) If the transferor fails to disclose the company’s debts truthfully, if the contract commitment and guarantee clauses stipulate the corresponding liability for breach of contract, the parties’ agreement shall be respected; if there is no agreement, the transferor’s liability for breach of contract shall be determined according to the contract purpose of the parties and the losses of the transferee.

④ We should strictly grasp the fundamental breach of contract. With regard to the termination of the equity transfer contract, the provisions on the termination of the contract in the Contract Part of the Civil Code shall apply. For the provisions of the part of the sales contract, it should be determined whether it can be applied according to the characteristics of equity transfer, and the influence of equity transfer on the company organization law should be fully considered, and equity transfer should not be simply equated with the sale of movable property and real estate. In the trial, such disputes will face the question of whether the breach of contract by one party will inevitably lead to the dissolution of the equity transfer agreement when the control right has been transferred. Once this kind of equity transfer contract is performed, if it has actually participated in the company’s operation and management, the company has completed the change registration and invested other resources, the fundamental breach of contract should be strictly grasped, and the frequent termination of the contract may have an adverse impact on the stability of the company’s operation and management.

2. Equity transfer contract involving company assets transfer

There are the following differences between asset transfer and equity transfer: First, the subjects are different. The transferor of assets transfer is the company, and the transferor of equity transfer is the shareholder of the company. Second, the legal effect is different. The transfer of assets is the transfer of property rights. In principle, the buyer does not bear the responsibility of the seller, and the creditor of the seller (company) can only claim rights from the seller (company), but not from the asset buyer. Equity transfer is only the change of the "owner" of the company, and the original creditor’s rights and debts of the company are still borne by the company unless otherwise agreed.

In principle, in the case of equity transfer, in the absence of special agreement, the transferee cannot hold the transferor responsible for the asset defects of the target company, because in the transaction arrangement of equity transfer, the transferor only has the obligation to guarantee the authenticity of the equity, but has no obligation to ensure the authenticity of the corresponding asset value represented by the equity, which is the risk that the transferee should bear. However, if the purpose of signing the equity transfer contract (accepting 100% equity of the target company) is to obtain the assets of the company, the equity transfer agreement makes special provisions on the handover of the assets of the target company and the liability for asset defects, and the agreement of the parties should also be respected.

The main points of relevant case review are as follows:

① Distinguish between asset transfer and equity transfer. In practice, there is a phenomenon that the concepts of asset transfer and equity transfer are confused. We should confirm the transfer object according to the contract agreement, the contents of negotiation between the two parties, the signing background and the performance after signing the contract, so as to determine the nature of the contract and clarify the rights and obligations of the parties to the contract.

②100% equity transfer and asset transfer can be handled according to the same principle. If the target of equity transfer is 100% equity of the target company, there is no essential difference between equity transfer and asset transfer. If the transferee of the asset transfer should bear the responsibility of defect guarantee, the transferee in the 100% equity transfer can also ask the transferor to bear the corresponding responsibility. After all, the equity represents the right holder’s control over the enterprise to a certain extent. The more shares, or the more shares held by the company, the stronger the shareholder’s control over the company.

③ Consideration of enterprise’s "defects" in the case of 100% equity transfer. In the case of 100% equity transfer, the purpose of the contract is usually for the transferee to gain control of the company. As far as an enterprise is concerned, even if there are some material and immaterial defects in the enterprise, it does not mean that the value of the enterprise will be impaired. In the end, the value of the enterprise depends on the cash flow of the enterprise and its value as a whole in the market. Many "defects" in the property or value of the enterprise may not be valued in the transaction of the enterprise, and they are not important under the overall framework of the transaction.

3. Equity transfer contract for the purpose of obtaining the company’s asset qualification.

In part of the equity transfer, in addition to gaining overall control of the company, the more direct purpose is to obtain the asset qualification of the company, such as the equity transfer of mining companies and real estate project companies. The main points of such contract review are as follows:

① If the relevant laws and regulations are clear, administrative approval is the effective requirement of the relevant project transfer contract, and the equity transfer contract also needs to be approved before it can take effect.

(2) If the law stipulates that the relevant administrative examination and approval is only for disciplinary actions, unless there are other circumstances that affect the effectiveness of the contract, the equity transfer contract is valid and binding on the parties, and the transferor takes approval and assistance in approval as one of his main obligations. If the parties are at fault for not being approved, they shall bear the liability for breach of contract.

4. "Equity transfer contract" in which the company is the transferor or transferee.

In practice, there are also "equity transfer contracts" in which the company is the transferor or transferee. Such disputes usually involve the transfer of control rights of the company, so this part will sort them out together:

(1) For the "equity transfer contract" in which the company is the transferor, the review points are as follows:

① According to the specific agreement and performance of the contract, it should be determined that the subject matter of the contract is the company’s assets or equity.

(2) If the object of the contract is equity, the transferor of the contract shall be determined according to the contents of the contract and the contracting process.

(2) For the "equity transfer contract" in which the company is the transferee, the review points are as follows:

① The parties to the equity transfer contract are the transferor and the transferee, and the target company is not a party to the contract, so the target company should not bear the transferee’s share payment obligation.

(2) If the parties to a contract agree that the target company shall perform the payment obligation, or agree that the target company shall assume the guarantee responsibility or provide guarantee for the transferee’s share payment obligation, the assets of the target company may be directly impaired, which may become an act of withdrawing capital in disguise, violating the principle of capital maintenance of the company, and ultimately damaging the independent property of the target company and the interests of creditors, and such an agreement may be deemed invalid according to the individual circumstances.

(3) For the above-mentioned guarantee liability or the guarantee provided by the company, if the target company has fulfilled the corresponding procedures with reference to the relevant provisions of Article 16 of the Company Law on the guarantee provided by the company, and there is no obvious harm to the interests of the creditors of the target company, it should not be deemed invalid on this ground.

five

Representation equity transfer contract

In practice, the share repurchase based on the gambling agreement can be classified as such disputes. In addition, the company’s acquisition of shares or shares and the guarantee of share assignment are also classified into this part.

1. Betting on the agreed terms of share repurchase

Gambling agreements, including those involving the agreement on share repurchase, are all contract tools used by investors to solve the problem of information asymmetry in the investment process. For share repurchase, agreements usually stipulate whether the target company will reach the agreed performance target and successfully go public in a certain period of time as the conditions for share repurchase. In the trial practice, when there is a dispute over the gambling agreement that stipulates the terms of share repurchase based on the terms of share repurchase, most of them enter the court on the grounds of equity transfer dispute. For the settlement of such disputes, we should not only pay attention to the agreement between the two parties, but also pay attention to the impact on the company’s organizational level and other stakeholders, so as to avoid the agreement of the parties harming the interests of the company and its creditors.

1.1 Gambling between investors and shareholders

(1) The determination of whether the repurchase clause is this agreement or an appointment, the review points are as follows:

(1) If the repurchase terms clearly stipulate the subject, price, performance period, liability for breach of contract and other substantive contents that affect the rights and obligations of the parties, it shall be deemed that both parties have reached an agreement on the share repurchase, which constitutes this Agreement.

(2) Without the above-mentioned substantive contents affecting the rights and obligations of the parties, the repurchase clause shall be deemed as an appointment, and the corresponding obligations and liabilities for breach of contract shall be determined according to Article 495 of the Civil Code.

(2) The identification of the repurchase period and the consequences of not claiming rights within the repurchase period are as follows:

(1) Under the condition that the repurchase term is not stipulated or unclear in the terms of repurchase, it is believed in principle that investors should be limited by a reasonable period when they ask shareholders or target companies to fulfill their repurchase obligations, and the judgment of a reasonable period should be based on the feasibility of exercising, time interval, fluctuation of equity value and other factors, and make a case judgment on the basis of balancing the interests of both parties.

(2) If the investor fails to claim the rights within the agreed time limit or reasonable time limit, in principle, it is considered that if the agreement is not clearly stipulated, it is not appropriate to assume that the investor’s right to claim repurchase in accordance with the repurchase terms will be extinguished, and the repurchase obligor still needs to perform its obligations as agreed. At the same time, the repurchase obligor may claim the liability for breach of contract for the losses caused by the investor’s overdue exercise.

(3) The adjustment of the share repurchase price, the review points are as follows:

The terms of share repurchase mostly stipulate that the repurchase price is "investment principal+investment income". Whether the above amount needs to be adjusted, especially whether it can be adjusted according to the provisions on the upper limit of interest protection in the Provisions of the Supreme People’s Court on Several Issues Concerning the Application of Laws in the Trial of Private Lending Cases, is controversial, and this issue will also be intertwined with the issue of "real debts of famous stocks". In the case that the parties have made a higher return agreement on high-risk project investment, it is not appropriate to simply adjust the return on investment with the name of equity investment or loan. We should explore the true meaning of the parties and comprehensively identify them according to the investment purpose, actual rights and obligations of the parties.

1.2 Gambling between investors and target companies

According to Article 5 of the Minutes of the Ninth People’s Congress, the relevant provisions of the Civil Code and the Company Law should be applied to the review of this issue. The main points of the review are as follows:

(1) The "gambling agreement" concluded between the investor and the target company shall not be supported if the target company claims that the "gambling agreement" is invalid only on the grounds that there is an equity repurchase agreement.

(2) Where an investor requests the target company to buy back its shares, it shall conduct an examination in accordance with the mandatory provisions of Article 35 of the Company Law that "shareholders shall not withdraw their capital contribution" or Article 142 of the Company Law on share repurchase. If the target company fails to complete the capital reduction procedure, it shall reject the investor’s application.

1.3 Gambling between investors and parties other than shareholders of the target company

Share repurchase is essentially a share transfer. In the case that the main body of the repurchase obligation is a party other than the shareholders of the target company, the performance of the repurchase obligation is restricted by the foreign share transfer in the Company Law, such as the pre-emptive right.

2. About the Company’s Acquisition of Equity

According to the provisions of Articles 74 and 142 of the Company Law, a company shall or may acquire shareholders’ equity or shares under the circumstances prescribed by law, which are discussed here.

2.1 About Limited Liability Company

According to Article 74 of the Company Law, the main points to be examined are as follows:

(1) Conditions for dissenting shareholders to request the company to purchase shares: In any of the following circumstances, the shareholders who voted against the resolution of the shareholders’ meeting may request the company to purchase its shares at a reasonable price: First, the company has not distributed profits to shareholders for five consecutive years, but the company has been making profits for five consecutive years and meets the conditions for distributing profits stipulated in this Law; Second, the company merges, divides or transfers its main property; Third, the business term stipulated in the articles of association of the company expires or other reasons for dissolution stipulated in the articles of association arise, and the shareholders’ meeting adopts a resolution to amend the articles of association to make the company survive. It is noteworthy that the third paragraph of Article 89 of the Second Revised Draft of the Company Law stipulates that the company’s equity acquired by the company in accordance with the first situation mentioned above shall be transferred or cancelled according to law within six months.

② Time limit for prosecution: If the shareholders and the company fail to reach an equity purchase agreement within 60 days from the date of adoption of the resolution of the shareholders’ meeting, the shareholders may sue within 90 days from the date of adoption of the resolution of the shareholders’ meeting.

2.2 About Limited by Share Ltd

According to the provisions of Article 142 of the Company Law, a joint stock limited company may not acquire shares of the company, but this article also provides for exceptions. The main points of review are as follows:

2.2.1 The situation that a joint stock limited company should acquire shares of the company.

Where a shareholder disagrees with the resolution of merger or division of the company made by the shareholders’ meeting and requests the company to purchase its shares, a joint stock limited company shall purchase the shares. After the acquisition of shares, the company shall transfer or cancel it within six months.

2.2.2 The situation in which a joint stock limited company can acquire shares of the company.

Where a joint stock limited company reduces its registered capital, it may purchase its shares. The company’s acquisition of shares of the company due to this situation shall be subject to the resolution of the shareholders’ meeting. After the company purchases shares, it shall cancel them within 10 days from the date of purchase.

Where a joint stock limited company merges with other companies holding shares in the company, it may acquire shares in the company. The company’s acquisition of shares of the company due to this situation shall be subject to the resolution of the shareholders’ meeting. After the company purchases shares, it shall transfer or cancel them within six months.

(3) If a joint stock limited company uses its shares for employee stock ownership plan or equity incentive, it may purchase its own shares. Where a company purchases shares of the company due to this situation, it may pass a resolution at a board meeting attended by more than two-thirds of the directors in accordance with the provisions of the articles of association or the authorization of the shareholders’ meeting. The total number of shares held by the company shall not exceed 10% of the total issued shares of the company, and shall be transferred or cancelled within three years.

(4) A joint stock limited company may purchase the shares of the company if it uses the shares for the conversion of corporate bonds convertible into shares issued by a listed company, or if it is necessary for the listed company to safeguard the company’s value and shareholders’ rights and interests. Where a company purchases shares of the company due to this situation, it may pass a resolution at a board meeting attended by more than two-thirds of the directors in accordance with the provisions of the articles of association or the authorization of the shareholders’ meeting. The total number of shares held by the company shall not exceed 10% of the total issued shares of the company, and shall be transferred or cancelled within three years. It should be noted that both of these situations are regulations for listed companies.

3. On the guarantee of equity transfer

In order to realize the purpose of equity transfer guarantee, the two parties usually sign an equity transfer contract, that is, to ensure that the debtor pays off the due debts, the two parties sign an equity transfer contract, and the debtor (equity transferor) informs the company of the equity change and cooperates with the company to change the creditor (transferee) into a shareholder of the company. If the debtor pays off the due debts, the creditor will cooperate with the company to change the debtor (transferor) into a shareholder of the company. According to the provisions of Articles 68 and 69 of the Interpretation of the Supreme People’s Court on the Application of the Guarantee System of the Civil Code of People’s Republic of China (PRC), the main points of the review are as follows:

(1) If both parties to the contract agree that the debtor will pay off his debts when they are due, the creditor shall notify the company and cooperate with the company to change the debtor (transferor) into a shareholder of the company. If the debtor fails to pay off his debts when they are due, the creditor may auction, sell off or pay off his debts at a discount, and the contract shall be deemed valid.

(2) If the parties to the contract agree that the debtor will pay off the debt when it is due, the creditor shall notify the company and cooperate with the company to change the debtor (assignor) into a shareholder of the company. If the debtor fails to pay off the debt when it is due and the creditor obtains the equity, the determination of its effectiveness shall be based on the provisions of the legal act validity part of the Civil Code, and shall be handled with reference to the provisions of Articles 401 and 428 of the Civil Code on mortgage and liquid.

(3) If both parties to the contract have not notified the company of the change of equity after signing the equity transfer contract, and have not registered the change of equity, strictly speaking, such a situation does not constitute a transfer guarantee. If the creditor (transferee) requests the debtor (transferor) to perform the equity transfer contract, it shall not support it, but the creditor may support it if it requests to give priority to the repayment of its creditor’s rights by auction, sale or discount of equity with reference to the provisions of the law on security interests.

(4) Shareholders provide guarantee for debt performance by transferring their equity to the creditors’ names. If the company or the creditors of the company request the creditors as nominal shareholders to bear joint and several liabilities with the shareholders on the grounds that the shareholders fail to perform or fully perform their capital contribution obligations, or withdraw their capital contribution, they shall not be supported.

⑤ The agreement of both parties in the assignment guarantee contract cannot be against the company and the third party.

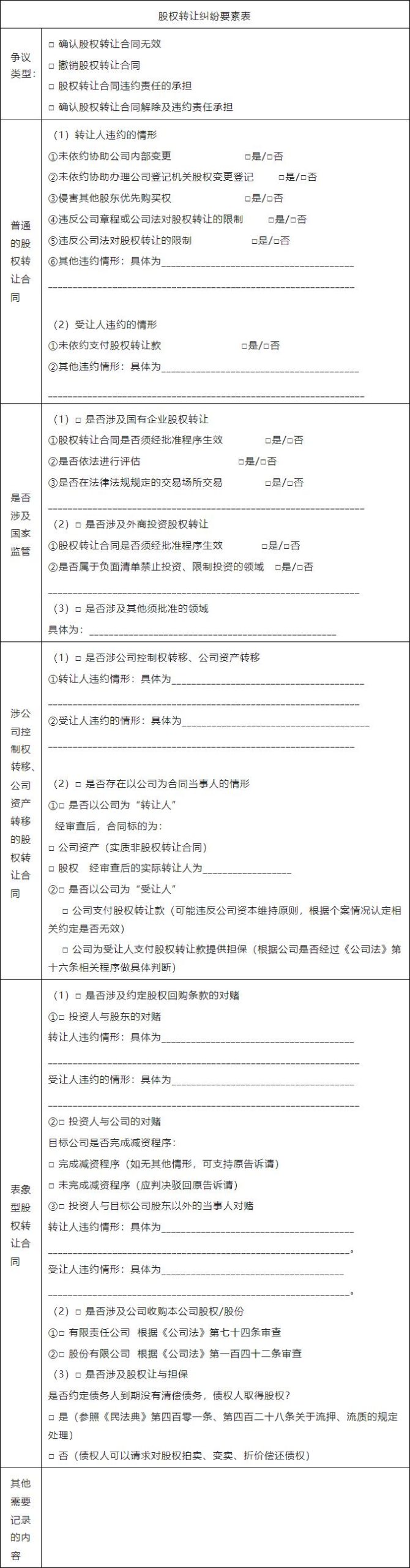

Specific information of case elements to be collected

Taking the above-mentioned review points as clues and paths, the court should pay attention to the following specific information of the trial elements in the trial of equity transfer disputes, and determine the facts that should be ascertained on the basis of focusing on the arguments of both parties:

1. Ordinary equity transfer contract

(1) Violation of the assignor’s obligations: failure to assist in the internal changes of the company, failure to assist in the registration of equity changes in the company registration authority, violation of the preemptive right of other shareholders, and violation of the restrictions on equity transfer in the company’s articles of association or company law.

(2) Breach of the assignee’s obligations: failure to pay the equity transfer payment.

2. Does it involve national supervision?

(1) Equity transfer contract of state-owned enterprises: whether the evaluation procedures and trading places comply with the legal provisions.

(2) Foreign-invested equity transfer contract: whether it belongs to the field where investment is prohibited or restricted in the negative list; Whether there is any violation of the consent right and preemptive right of other shareholders of foreign-invested enterprises.

(3) the equity transfer contract that must be approved by the administrative organ: whether the equity transfer contract is approved; If it is not approved, does the plaintiff only file a lawsuit against the effective approval obligation clause?

3. Equity transfer contracts involving the transfer of company control rights and assets.

(1) Equity transfer contract involving the transfer of control rights of the company: whether the contractual agreement conflicts with the company law, and pay attention to reviewing the transferor’s main contractual obligations.

(2) Equity transfer contract involving company assets transfer: distinguish between asset transfer and equity transfer, and judge whether the purpose of equity transfer is to acquire company assets.

(3) Equity transfer contract for the purpose of obtaining the company’s asset qualification: whether the purpose of equity transfer is to obtain the company’s qualification and administrative approval are the effective elements of the relevant project transfer contract.

(4) "Equity transfer contract" in which the company is the party: if the company is the transferor, it should identify the real transferor, and if the company is the transferee, it should pay attention to examining whether there is any capital flight.

4. Representation equity transfer contract

(1) Betting on the agreed terms of share repurchase: Differentiate the objects to be gambled, identify the legal consequences differently, and pay attention to the identification of "famous stocks and real debts".

(2) Acquisition of equity by the company: Check whether there are any circumstances stipulated in Articles 74 and 142 of the Company Law.

(3) On the guarantee of equity transfer: the agreement to distinguish whether to complete the change of the company’s internal shareholder list or the registration of equity change, and the creditor’s acquisition of equity due to the debtor’s outstanding debts is invalid.

Factor-based trial and documents

one

Factor trial

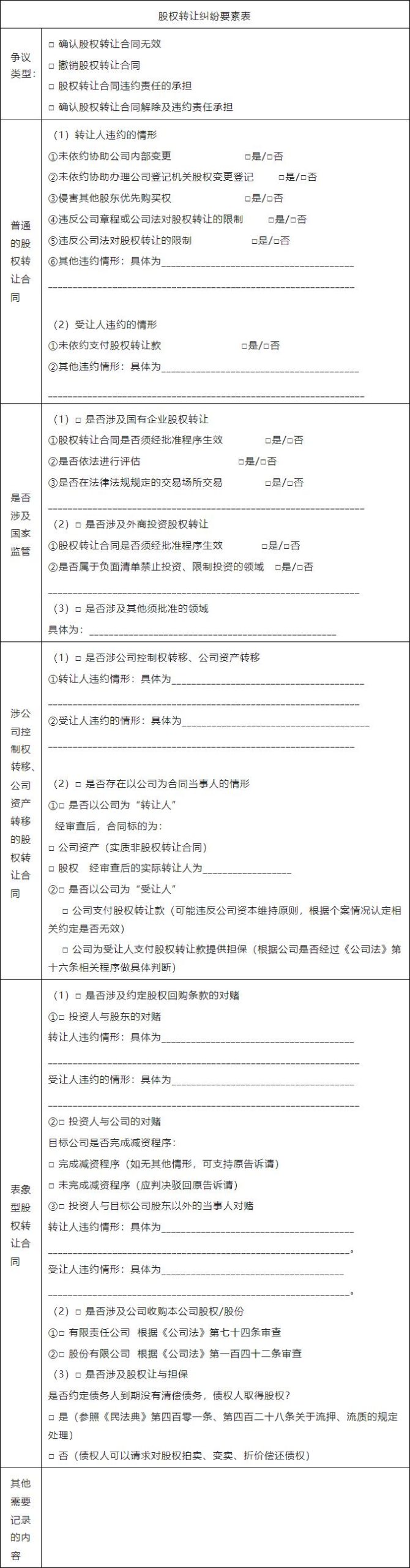

During the trial, the judge can gradually improve the following Elements Table of Equity Transfer Disputes according to the evidence and cross-examination, court questioning and court debate of both parties. After the trial is over, the Elements Table of Equity Transfer Disputes can be completed and the disputes between the two parties can be clarified. Factor-based trial can help judges quickly lock the focus of disputes, find out the facts of the case, determine the effectiveness of the contract, and determine the rights and obligations of both parties according to the agreement of the equity transfer contract, and then determine whether the parties have breached the contract and whether the contract has been terminated.

two

Essential judgment