The century debate between Einstein and Bohr was tested on China’s "Mozi" quantum satellite.

Author: Lin Mei

Editor: Bai Ze

Source: Mozi Salon

The century puzzle left by Einstein and Bohr to future generations

In the early days of the establishment of quantum mechanics, the phenomenon of "entanglement" aroused the curiosity of all physicists, and Einstein called it "strange interaction between distant places."The so-called entanglement in quantum mechanics is a phenomenon: two particles in an entangled state can maintain a special correlation state, and the state of both particles is unknown, but as long as one particle is measured, the state of the other particle can be known immediately, even if they are far apart.. In the past half century, the essence behind this phenomenon has been deeply puzzling scientists.

In the last century, the views on entanglement divided physicists into two factions: the Copenhagen school, represented by Bohr, believed that the so-called "reality" was meaningful only when it was connected with observation methods; But scientists such as Einstein can’t accept this view. They think that quantum mechanics is incomplete, and the measurement result must be predetermined by some kind of "hidden variable", but we can’t detect it. In 1935, Einstein, Podolsky and Rosen published an article entitled Can Quantum Mechanics Description of Physical Reality Be Considered Complete, demonstrating the incompleteness of quantum mechanics. Usually, people call their argument EPR Paradox or Einstein Localized Realism.

Bohr and Einstein argued about this for 50 years, and the problem was not solved until their final death, which has always attracted future generations to verify it.

How to verify it?

mentionLocalized realismIn fact, it contains two meanings:First, physical realism.Any observable physical quantity must exist objectively in a definite way, and if there is no external disturbance, the observable physical quantity should have a definite value;Second, localized causality.If the four-dimensional space-time between two events is space-like, there is no causal relationship between the two events. Based on this understanding, in 1964, the Irish physicist Bell put forward the famous "Bell Inequality", which established a strict limit on the possible correlation degree of the results when two separated particles were measured at the same time [1]. If Bell inequality is not established in the experiment, it means that the expectation based on localized realism does not conform to the theory of quantum mechanics, that is,The quantum world itself is probabilistic.

All along, people have designed various experimental schemes to verify whether Bell’s inequality is correct or not, and one after another, the results of some experimental groups tend to support the destruction of Bell’s inequality-that is, to prove the correctness of quantum mechanics. The first truly definitive experiment was made by Spector, a French physicist. Three experiments they made in the 1970s gave a clear conclusion about the nonlocality of quantum mechanics, but there were still loopholes in the initial verification of these experiments. In recent years, experimental groups in different countries have tried to gradually close local vulnerabilities, free choice vulnerabilities and detection efficiency vulnerabilities in their experiments.All the experimental results support the conclusion of quantum mechanics and prove that localized realism is wrong.

Bell inequality goes out of the laboratory and flies further.

The destruction of Bell inequality has been verified in the laboratory, so what about the situation on a larger scale? If people can verify the existence of quantum entanglement at a longer distance, it means verifying the correctness of quantum mechanics at a larger spatial scale. Therefore, people want to fly farther with Bell inequality. However, there is a stumbling block-attenuation when conducting experiments on a larger scale. What does this mean? In the actual experimentPeople often use an experiment called "quantum entanglement distribution" to verify Bell inequality, which is to send two prepared entangled particles (usually photons) to two points far apart, and to verify whether quantum mechanics and localized realism are right or wrong by observing whether the measurement results of the two points conform to Bell inequality.Because pairs of single photons are prepared and sent, the signal of single photon is not amplified because of the non-replicability of quantum, and the inherent photon loss of optical fiber makes it difficult to expand the optical quantum transmission to a longer distance. On the surface of the earth, the quantum entanglement distribution of 100 kilometers is almost the limit.

What should we do? There are two schemes,One is to use quantum relay.One relay station is a bit like an ancient relay station, transmitting photons one by one, but at present, the research of quantum relay is still limited by the time and efficiency of quantum storage;Another scheme is to realize quantum entanglement distribution by satellite.The vacuum environment in outer space has almost no attenuation and decoherence effects on light transmission. The free space channel loss between the satellite and the earth is small, and even in theory, scientists can establish a quantum channel between any two points on the earth by using satellites, and it is possible to realize quantum entanglement distribution at a long distance on a global scale.

On December 9, 2016, at the Ali Observatory in Tibet, researchers were doing experiments.

Fortunately, in this respect, Chinese is at the forefront of the world.

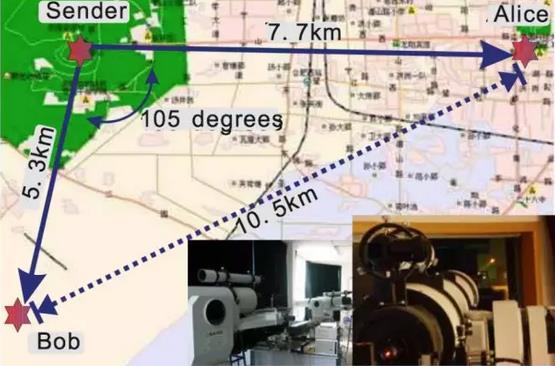

As early as 2003, China’s Pan Jianwei team put forward a scheme to realize long-distance quantum entanglement distribution by satellite, and started preliminary verification. The team’s researchers believe that in order to prove that it is feasible for satellites to realize quantum entanglement distribution, it is necessary to prove that photons can remain coherent after penetrating the atmosphere, so they began to do experiments in Dashu Mountain, Hefei. In this experiment, the sender is in Dashu Mountain, and the two receiving points are in Feixi farmer’s home and the west campus of Chinese University of Science and Technology, which are several kilometers away. It is the first time in the world to realize the two-way quantum entanglement distribution in free space with a horizontal distance of 13 kilometers (the vertical thickness of the atmosphere is about 5-10 kilometers), which proves that the entangled state can still "survive" after long-distance atmospheric channel transmission. On the other hand, this transmission distance exceeds the equivalent thickness of the atmosphere, which proves the feasibility of long-distance free space quantum communication.

Two-way quantum entanglement distribution in free space with a horizontal distance of 13 kilometers in 2005

In 2010, the team realized the 16 km quantum teleportation based on quantum entanglement distribution for the first time in the world. Based on the preliminary key technical preparations, at the end of 2011, the strategic pilot science and technology project "Quantum Science Experimental Satellite" of Chinese Academy of Sciences was formally established. In 2012, the joint research team of Chinese Academy of Sciences led by Pan Jianwei realized the first quantum entanglement distribution experiment of more than 102km in Qinghai Lake. In the experiment, the maximum attenuation is 80dB. On the one hand, it is verified that the entanglement characteristics still survive through the atmospheric channel on a larger scale, on the other hand, it is verified that the entanglement characteristics can be maintained under the condition of very large attenuation, which further verifies the feasibility of satellite-ground entanglement distribution.

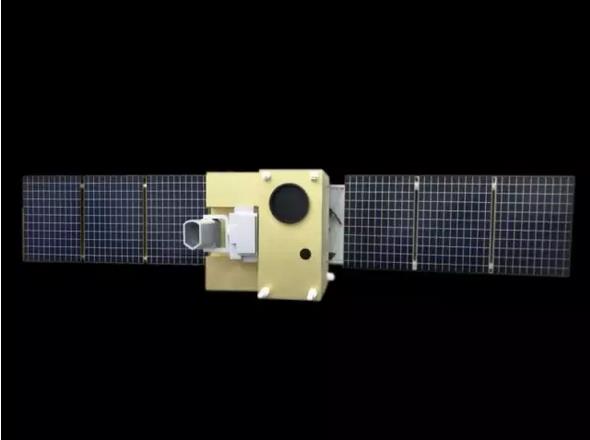

In the following years, the team worked hard to overcome various difficulties and finally developed the "Mozi" quantum science experimental satellite. In the eyes of hundreds of millions of people, the Mozi was successfully put into orbit on August 16, 2016. After four months of on-orbit testing, it was officially delivered to carry out scientific experiments on January 18, 2017.

Mozi quantum science experimental satellite

As one of the three scientific experimental tasks of Mozi satellite, satellite-ground quantum entanglement distribution is the first quantum entanglement distribution experiment on the spatial scale in the world.

There are three optical payloads on the Mozi quantum science experimental satellite. Pairs of entangled photons are prepared by the quantum entangled light source and sent by two optical antennas. When the satellite transits the border, two telescopes point to Delingha and Lijiang ground stations respectively. The receiving systems of the two ground stations, according to the angular velocity of the satellite, make the satellite establish quantum channels with the two ground stations at the same time and send entangled photons to the ground stations.Then the ground station carries out entanglement measurement of photons, and if there are enough statistics, the Bell inequality can be verified.

In this experiment, the distance between the two ground stations is 1200 kilometers, the total distance from the satellite to the two ground stations is 2000 kilometers on average, the tracking accuracy of the ground station reaches 0.4 urad, and the receiving efficiency of the ground station system is more than 20%. The entanglement source on the satellite can generate 8 million entangled photon pairs per second, and the establishment of optical link can establish quantum entanglement between two stations over 1200 kilometers on the ground at the speed of 1 pair per second, so that a large number of statistical data can be obtained in a short time. If photons are transmitted by optical fiber over such a long distance, even if ultra-low loss optical fiber is selected, it will take 30 thousand years to distribute a pair of photons.

In the experiment, the two photons are pulled apart by a large enough distance, and at the same time, the high-precision experimental technology ensures that the independent measurement time interval between the two places is small enough, which meets the measurement requirements of "space-like interval" in Bell inequality measurement and closes the localization vulnerability and measurement selection vulnerability.The experimental results show that the standard deviation of 4 times violates Bell inequality, that is, the correctness of quantum mechanics is verified at a distance of thousands of kilometers with a confidence of over 99.9%.The nonlocality test of quantum mechanics which strictly satisfies Einstein’s localization condition is realized. This important achievement has laid a reliable technical foundation for the future experimental study of large-scale quantum networks and quantum communication, as well as the experimental examination of the basic principles of physics such as general relativity and quantum gravity in outer space.

Related achievements were published in the international authoritative academic journal Science in the form of cover papers.. In addition to the quantum entanglement distribution experiment, other important scientific experimental tasks of Mozi quantum science experimental satellite, including high-speed satellite-ground quantum key distribution, satellite-ground quantum teleportation and so on, are also under intense and smooth progress. It is expected that more scientific achievements will be released to the public one after another this year.

On November 28, 2016, at the Xinglong Observatory in Hebei Province, the "Mozi" quantum science experimental satellite transited.

Note:

[1]Bell inequality has many famous generalizations. Considering the practical factors of the experiment, five years after Bell inequality was put forward, John Clauser, Michael Horne, Abner Shimony and Richard A. Holt put forward a CHSH inequality, and the experiment of Bell inequality in later experiments was mainly to verify CHSH inequality.

[2] Space-like separation means that the space-time interval of two events satisfies that "it is impossible to communicate between two events with information below the speed of light.

Thanks to Associate Research Fellows Zhang Wenzhuo, Zou Mi and Li Dongdong of Hefei Microscale Laboratory of China University of Science and Technology for their help in writing this article.