Xinhua News Agency, Beijing, December 26th

People’s Republic of China (PRC) national defense law

(Adopted at the Fifth Session of the Eighth National People’s Congress on March 14, 1997)

According to the Decision on Amending Some Laws of the 10th Session of the 11th the NPC Standing Committee on August 27th, 2009.

Revised at the 24th meeting of the 13th the NPC Standing Committee on December 26th, 2020)

Catalogue

Chapter I General Principles

Chapter II National Defense Functions and Powers of State Organs

Chapter III Armed Forces

Chapter IV Defense in Frontier Defense, Coastal Defense, Air Defense and Other Major Security Fields

Chapter V National Defense Scientific Research, Production and Military Procurement

Chapter VI National Defense Funds and National Defense Assets

Chapter VII National Defense Education

Chapter VIII National Defense Mobilization and State of War

Chapter IX National Defense Obligations and Rights of Citizens and Organizations

Chapter X Obligations and Rights and Interests of Soldiers

Chapter XI Foreign Military Relations

Chapter XII Supplementary Provisions

Chapter I General Principles

Article 1 This Law is formulated in accordance with the Constitution for the purpose of building and consolidating national defense, ensuring the smooth progress of reform, opening up and socialist modernization, and realizing the great rejuvenation of the Chinese nation.

Article 2 This Law is applicable to the military activities carried out by the state to guard against and resist aggression, stop armed subversion and division, and safeguard national sovereignty, unity, territorial integrity, security and development interests, as well as military-related political, economic, diplomatic, scientific, technological and educational activities.

Article 3 National defense is the security guarantee for the survival and development of the country.

The state strengthens the construction of armed forces, strengthens the defense construction in frontier defense, coastal defense, air defense and other major security fields, develops national defense scientific research and production, popularizes national defense education for the whole people, improves the national defense mobilization system, and realizes national defense modernization.

Article 4 National defense activities adhere to the guidance of Marxism–Leninism, Mao Zedong Thought, Deng Xiaoping Theory, Theory of Three Represents, Scientific Outlook on Development and the Supreme Leader’s Thought of the New Era, implement the Supreme Leader’s Thought of Strengthening the Army, adhere to the overall concept of national security, implement the military strategic policy of the new era, and build a consolidated national defense and powerful armed force commensurate with China’s international status and compatible with national security and development interests.

Article 5 The State exercises unified leadership over national defense activities.

Article 6 People’s Republic of China (PRC) pursues a defensive national defense policy, independently builds and consolidates national defense, actively defends and upholds national defense for all.

The state adheres to the coordinated, balanced and compatible development of economic construction and national defense construction, carries out national defense activities in accordance with the law, accelerates the modernization of national defense and the armed forces, and realizes the unification of enriching the country and strengthening the armed forces.

Article 7 It is the sacred duty of every citizen in People’s Republic of China (PRC) to defend the motherland and resist aggression.

People’s Republic of China (PRC) citizens should fulfill their national defense obligations according to law.

All state organs and armed forces, political parties and people’s organizations, enterprises, institutions, social organizations and other organizations should support and participate in national defense construction according to law, perform national defense duties and complete national defense tasks.

Article 8 The state and society respect and give preferential treatment to servicemen, safeguard their status and legitimate rights and interests, and carry out various forms of activities of supporting the army and giving priority to their families, so that servicemen can become a respected profession of the whole society.

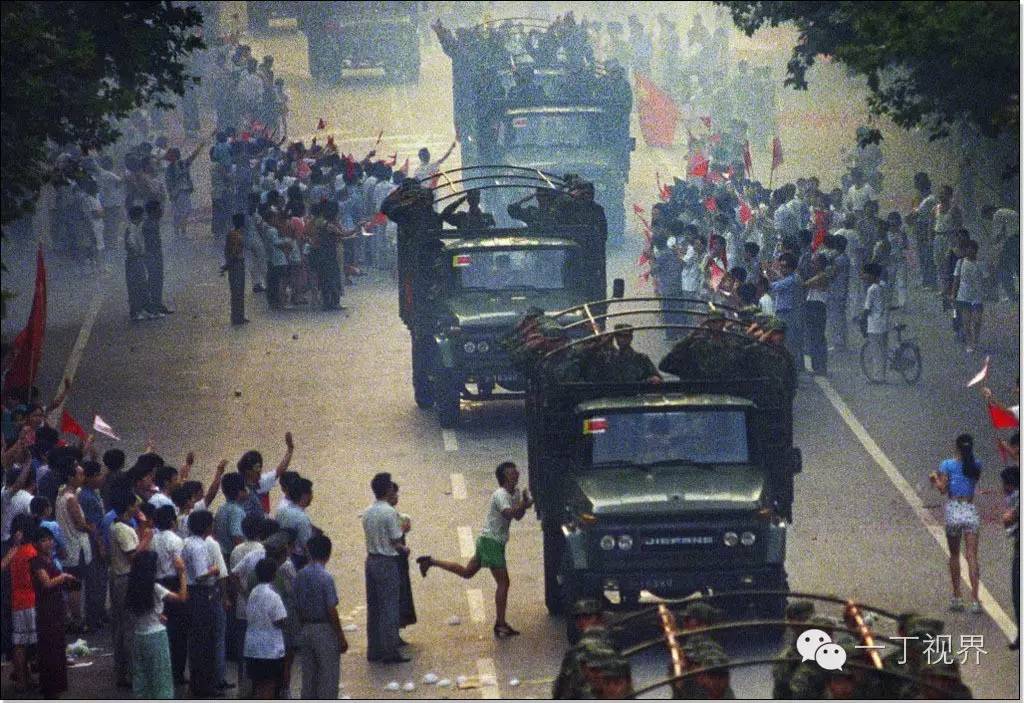

The China People’s Liberation Army and the Chinese People’s Armed Police Force carried out activities to support the government and love the people, and consolidated the unity of the army, the government and the people.

Article 9 People’s Republic of China (PRC) actively promotes international military exchanges and cooperation, safeguards world peace and opposes acts of aggression and expansion.

Article 10 Organizations and individuals who have made contributions to national defense activities shall be commended and rewarded in accordance with the provisions of relevant laws and regulations.

Article 11 Any organization or individual that violates this Law and other relevant laws, refuses to perform national defense obligations or endangers national defense interests shall be investigated for legal responsibility according to law.

Public officials who abuse their powers, neglect their duties or engage in malpractices for selfish ends in national defense activities shall be investigated for legal responsibility according to law.

Chapter II National Defense Functions and Powers of State Organs

Article 12 The National People’s Congress decides on issues of war and peace in accordance with the provisions of the Constitution, and exercises other functions and powers in national defense as stipulated in the Constitution.

In accordance with the provisions of the Constitution, the NPC Standing Committee decides to declare a state of war, decide on national general mobilization or partial mobilization, and exercise other functions and powers in national defense as stipulated in the Constitution.

Article 13 In accordance with the decisions of the National People’s Congress and the NPC Standing Committee, President People’s Republic of China (PRC) declared a state of war, issued a mobilization order, and exercised other functions and powers in national defense as stipulated in the Constitution.

Fourteenth the State Council leadership and management of national defense construction, exercise the following functions and powers:

(a) the preparation of relevant development plans and plans for national defense construction;

(2) Formulating relevant policies and administrative regulations on national defense construction;

(3) to lead and manage national defense scientific research and production;

(four) the management of national defense funds and national defense assets;

(five) to lead and manage the mobilization of the national economy and the construction and organization of civil air defense and national defense transportation;

(six) the leadership and management of yongjunyoushu work and retired military security work;

(7) Co-leading the construction of militia, conscription and management of defense in frontier defense, coastal defense, air defense and other major security fields with the Central Military Commission (CMC);

(eight) other functions and powers related to national defense construction as prescribed by law.

Article 15 the Central Military Commission (CMC) leads the national armed forces and exercises the following functions and powers:

(a) unified command of the national armed forces;

(2) to decide on the military strategy and the operational policy of the armed forces;

(three) to lead and manage the construction of the China People’s Liberation Army and the Chinese People’s Armed Police Force, formulate plans and organize their implementation;

(four) to submit a motion to the National People’s Congress or the NPC Standing Committee;

(5) To formulate military regulations and issue decisions and orders in accordance with the Constitution and laws;

(6) To decide on the system and establishment of the China People’s Liberation Army and the Chinese People’s Armed Police Force, and to stipulate the tasks and responsibilities of the Central Military Commission (CMC) government departments, war zones, services and arms, the Chinese People’s Armed Police Force and other units;

(seven) in accordance with the provisions of laws and military regulations, the appointment and removal, training, assessment and reward and punishment of members of the armed forces;

(eight) to decide on the weapons and equipment system of the armed forces, formulate weapons and equipment development plans, and cooperate with the State Council to lead and manage national defense scientific research and production;

(nine) to manage national defense funds and national defense assets in conjunction with the State Council;

(ten) to lead and manage the mobilization and reserve work of the people’s armed forces;

(eleven) to organize international military exchanges and cooperation;

(twelve) other functions and powers as prescribed by law.

Article 16 the Central Military Commission (CMC) implements the chairman responsibility system.

Seventeenth the State Council and the Central Military Commission (CMC) to establish a coordination mechanism to solve major issues of national defense affairs.

The central state organs and the relevant departments of the Central Military Commission (CMC) organs may hold meetings according to the situation to coordinate and solve problems related to national defense affairs.

Article 18 Local people’s congresses at various levels and the standing committees of local people’s congresses at or above the county level shall, within their respective administrative areas, ensure the observance and implementation of laws and regulations on national defense affairs.

Local people’s governments at various levels shall, within the limits of authority prescribed by law, administer the work of conscription, militia, mobilization of national economy, civil air defense, national defense transportation, protection of national defense facilities, and protection and preferential treatment of demobilized soldiers.

Article 19 Local people’s governments at all levels and resident military organs shall convene joint meetings of the military and the land as needed to coordinate and solve problems related to national defense affairs within their respective administrative areas.

The joint military-civilian meeting shall be convened jointly by the responsible persons of the local people’s governments and the resident military organs. The participants in the joint military-civilian meeting shall be determined by the convener.

Matters agreed upon at the joint meeting of the military and local authorities shall be handled by the local people’s government and the resident military organs according to their respective responsibilities and tasks, and major matters shall be reported to their superiors respectively.

Chapter III Armed Forces

Article 20 The armed forces of People’s Republic of China (PRC) belong to the people. Its task is to consolidate national defense, resist aggression, defend the motherland, safeguard the people’s peaceful labor, participate in national construction, and serve the people wholeheartedly.

Article 21 The armed forces of People’s Republic of China (PRC) are under the leadership of the Communist Party of China (CPC). The Communist Party of China (CPC) organizations in the armed forces carry out their activities in accordance with Constitution of the Communist Party of China.

Article 22 The armed forces of People’s Republic of China (PRC) are composed of the China People’s Liberation Army, the Chinese People’s Armed Police Force and the militia.

The China People’s Liberation Army is composed of active and reserve forces. Its mission in the new era is to provide strategic support for consolidating the Communist Party of China (CPC)’s leadership and socialist system, defending national sovereignty, unity and territorial integrity, safeguarding national overseas interests and promoting world peace and development. Active duty troops are the standing army of the country, mainly responsible for defensive operations and carrying out non-war military operations in accordance with regulations. The reserve forces shall conduct military training and carry out defensive operations and non-war military operations in accordance with regulations; According to the mobilization order issued by the state, the Central Military Commission (CMC) issued an order to be transferred to active service.

The Chinese People’s Armed Police Force is responsible for duty, handling social security emergencies, preventing and handling terrorist activities, maritime rights enforcement, emergency rescue and defensive operations, and other tasks entrusted by the Central Military Commission (CMC).

The militia, under the command of military organs, undertakes combat readiness, non-war military operations and defensive operations.

Article 23 The armed forces of People’s Republic of China (PRC) must abide by the Constitution and laws.

Article 24 People’s Republic of China (PRC)’s armed forces should adhere to the road of strengthening the army with China characteristics, strengthen the army with politics, reform, science and technology, strengthen the army with talents, manage the army according to law, strengthen military training, carry out political work, improve the level of security, comprehensively promote the modernization of military theory, military organization, military personnel and weapons and equipment, build a modern combat system with China characteristics, comprehensively improve combat effectiveness, and strive to achieve the Party’s goal of strengthening the army in the new era.

Article 25 The size of People’s Republic of China (PRC)’s armed forces should meet the needs of safeguarding national sovereignty, security and development interests.

Article 26 Military service in People’s Republic of China (PRC) is divided into active service and reserve service. The service system for servicemen and reservists shall be prescribed by law.

The China People’s Liberation Army and the Chinese People’s Armed Police Force implement the rank system in accordance with the law.

Article 27 The China People’s Liberation Army and the Chinese People’s Armed Police Force shall practise a civilian personnel system in their designated posts.

Article 28 The flag and emblem of China People’s Liberation Army are the symbols and symbols of China People’s Liberation Army. The flag and emblem of the Chinese People’s Armed Police Force are the symbols and symbols of the Chinese People’s Armed Police Force.

Citizens and organizations shall respect the flag and emblem of the China People’s Liberation Army and the flag and emblem of the Chinese People’s Armed Police Force.

The design, style and management measures for the flag and emblem of the China People’s Liberation Army and the flag and emblem of the Chinese People’s Armed Police Force shall be formulated by the Central Military Commission (CMC).

Article 29 The State prohibits any organization or individual from illegally establishing an armed organization, illegal armed activities and posing as a soldier or armed forces organization.

Chapter IV Defense in Frontier Defense, Coastal Defense, Air Defense and Other Major Security Fields

Article 30 People’s Republic of China (PRC)’s territorial land, waters and airspace are inviolable. The state builds strong and stable modern frontier defense, coastal defense and air defense, and adopts effective defense and management measures to safeguard the safety of territorial land, territorial waters and airspace and safeguard the national maritime rights and interests.

The state takes necessary measures to safeguard the safety of activities, assets and other interests in other major security fields such as space, electromagnetism and cyberspace.

Article 31 the Central Military Commission (CMC) shall exercise unified leadership over defense work in frontier defense, coastal defense, air defense and other major security fields.

The central state organs, local people’s governments at various levels and relevant military organs shall, within the prescribed scope of functions and powers, be responsible for the management and defense of frontier defense, coastal defense, air defense and other major security areas in a division of labor, and jointly safeguard national security and interests.

Article 32 The state shall, according to the needs of defense in frontier defense, coastal defense, air defense and other major security fields, strengthen the construction of defense forces and build defense facilities such as operations, command, communications, measurement and control, navigation, protection, transportation and security. People’s governments at all levels and military organs shall, in accordance with the provisions of laws and regulations, ensure the construction of national defense facilities and protect the safety of national defense facilities.

Chapter V National Defense Scientific Research, Production and Military Procurement

Article 33 The state establishes and improves the national defense science, technology and industry system, develops national defense scientific research and production, and provides the armed forces with weapons and equipment with advanced performance, reliable quality, complete supporting facilities, convenient operation and maintenance, and other applicable military materials to meet the needs of national defense.

Article 34 The national defense science, technology and industry shall follow the policy of combining military and civilian, combining peacetime and wartime, giving priority to military products, being driven by innovation, and being independent and controllable.

The state makes overall plans for the construction of national defense science, technology and industry, adheres to the principle of national leadership, division of labor and cooperation, professional support, openness and integration, and maintains the national defense scientific research and production capacity with appropriate scale and reasonable layout.

Article 35 The state makes full use of the superior resources of the whole society, promotes the progress of national defense science and technology, speeds up independent research and development of technology, gives full play to the leading role of high and new technologies in the development of weapons and equipment, increases technical reserves, improves the national defense intellectual property system, promotes the transformation of national defense scientific and technological achievements, promotes the sharing and collaborative innovation of scientific and technological resources, and improves the national defense scientific research capability and the technical level of weapons and equipment.

Article 36 The state creates favorable environment and conditions, strengthens the training of national defense science and technology talents, encourages and attracts outstanding talents to enter the field of national defense scientific research and production, and stimulates the innovative vitality of talents.

National defense science and technology workers should be respected by the whole society. The state gradually improves the treatment of national defense science and technology workers and protects their legitimate rights and interests.

Article 37 The State practices a military procurement system according to law to ensure the procurement and supply of weapons and equipment, materials, projects and services needed by the armed forces.

Article 38 The State exercises unified leadership and planned control over national defense scientific research and production. Pay attention to the role of market mechanism and promote fair competition in national defense scientific research and production and military procurement activities.

The state provides necessary guarantee conditions and preferential policies for organizations and individuals undertaking national defense scientific research and production tasks and accepting military procurement according to law. Local people’s governments at all levels shall provide assistance and support to organizations and individuals that undertake national defense scientific research and production tasks and accept military procurement according to law.

Organizations and individuals undertaking national defense scientific research and production tasks and accepting military procurement should keep secrets, complete tasks in a timely and efficient manner, ensure quality and provide corresponding service guarantees.

The state implements a system of quality responsibility investigation for weapons and equipment, materials, projects and services supplied to the armed forces according to law.

Chapter VI National Defense Funds and National Defense Assets

Article 39 The state guarantees the necessary funds for national defense. The growth of national defense funds should be compatible with national defense demand and the level of national economic development.

National defense funds shall be subject to budget management according to law.

Article 40 The funds directly invested by the state for the construction of armed forces, national defense scientific research and production and other national defense construction, the allocated land and other resources, and the resulting weapons and equipment, equipment and facilities, materials and equipment, and technological achievements used for national defense purposes belong to national defense assets.

National defense assets belong to the state.

Article 41 The state shall, according to the needs of national defense and economic construction, determine the scale, structure and layout of national defense assets, and adjust and dispose of national defense assets.

The management institutions and units that possess and use national defense assets shall manage national defense assets according to law and give full play to their effectiveness.

Article 42 The state protects national defense assets from infringement and ensures the safety, integrity and effectiveness of national defense assets.

It is forbidden for any organization or individual to destroy, damage or occupy national defense assets. Without the approval of institutions authorized by the State Council, the Central Military Commission (CMC), the State Council and the Central Military Commission (CMC), the possessor or user of national defense assets shall not change the use of national defense assets for national defense purposes. The technological achievements in national defense assets can be used for other purposes in accordance with the relevant provisions of the state on the premise of adhering to national defense priority and ensuring safety.

The management organization of national defense assets or the units that possess and use national defense assets that are no longer used for national defense purposes shall, in accordance with the provisions, submit for approval, and use them for other purposes or dispose of them according to law.

Chapter VII National Defense Education

Article 43 Through national defense education, the state enables all citizens to enhance their sense of national defense, strengthen their sense of hardship, master national defense knowledge, improve their national defense skills, carry forward the spirit of patriotism, and fulfill their national defense obligations according to law.

Popularizing and strengthening national defense education is the common responsibility of the whole society.

Article 44 National defense education adheres to the principle of participation by the whole people, long-term persistence and practical results, and implements the principles of combining regular education with centralized education, combining universal education with key education, and combining theoretical education with behavioral education.

Forty-fifth national defense education departments should strengthen the organization and management of national defense education, and other relevant departments should do a good job in national defense education in accordance with the prescribed responsibilities.

Military organs shall support relevant organs and organizations to carry out national defense education and provide relevant facilities according to law.

All state organs, armed forces, political parties, people’s organizations, enterprises, institutions, social organizations and other organizations shall organize their own regions, departments and units to carry out national defense education.

National defense education in schools is the basis of national defense education for all. Schools at all levels and types should set up appropriate national defense education courses, or increase the content of national defense education in relevant courses. Ordinary institutions of higher learning and high school schools shall organize military training for students in accordance with regulations.

Public officials should actively participate in national defense education, improve national defense literacy, and play an exemplary role in national defense education for all.

Forty-sixth people’s governments at all levels should incorporate national defense education into the national economic and social development plan to ensure the funds needed for national defense education.

Chapter VIII National Defense Mobilization and State of War

Article 47 When People’s Republic of China (PRC)’s sovereignty, unity, territorial integrity, security and development interests are threatened, the state shall, in accordance with the provisions of the Constitution and laws, carry out national general mobilization or partial mobilization.

Article 48 The State shall incorporate the preparations for national defense mobilization into the overall national development plan and plan, improve the national defense mobilization system, enhance the national defense mobilization potential and enhance the national defense mobilization capability.

Article 49 The State establishes a strategic material reserve system. Strategic material reserves should be of moderate scale, safe storage, convenient call and regular replacement to ensure wartime needs.

Article 50 Relevant departments of the national defense mobilization leading bodies, central state organs and the Central Military Commission (CMC) organs shall organize the preparation and implementation of national defense mobilization in accordance with the division of responsibilities.

All state organs and armed forces, political parties and people’s organizations, enterprises, institutions, social organizations, other organizations and citizens must complete preparations for national defense mobilization in accordance with the law; After the mobilization order is issued by the state, the required national defense mobilization task must be completed.

Article 51 The state may, according to the needs of national defense mobilization, expropriate and requisition the equipment, facilities, means of transportation, places and other property of organizations and individuals according to law.

The people’s governments at or above the county level shall, in accordance with the relevant provisions of the state, give fair and reasonable compensation for the direct economic losses caused by the expropriation and requisition.

Article 52 The state declares a state of war in accordance with the provisions of the Constitution, and adopts various measures to concentrate manpower, material resources and financial resources to lead all citizens to defend the motherland and resist aggression.

Chapter IX National Defense Obligations and Rights of Citizens and Organizations

Article 53 It is the glorious duty of People’s Republic of China (PRC) citizens to perform military service and join militia organizations in accordance with the law.

Military service organs at all levels and people’s armed institutions at the grass-roots level shall handle military service according to law, complete conscription tasks according to the orders of the State Council and the Central Military Commission (CMC), and ensure the quality of soldiers. Relevant state organs, people’s organizations, enterprises, institutions, social organizations and other organizations shall complete the militia and reserve work in accordance with the law and assist in the task of conscription.

Article 54 Enterprises, institutions and individuals undertaking national defense scientific research and production tasks or accepting military procurement shall provide weapons and equipment or materials, projects and services that meet quality standards as required.

Enterprises, institutions and individuals shall, in accordance with state regulations, implement national defense requirements in construction projects closely related to national defense and safeguard the needs of national defense construction and military operations according to law. The management and operation units of transportation facilities such as stations, ports, airports and roads shall provide priority services for the passage of military personnel, military vehicles and ships, and give preferential treatment in accordance with regulations.

Article 55 Citizens shall receive national defense education.

Citizens and organizations shall protect national defense facilities and shall not destroy or endanger them.

Citizens and organizations shall abide by the confidentiality provisions, and shall not disclose state secrets in national defense, and shall not illegally hold secret documents, materials and other secret articles in national defense.

Article 56 Citizens and organizations shall support national defense construction and provide convenience or other assistance for military training, combat readiness, defensive operations and non-war military operations of the armed forces.

The state encourages and supports qualified citizens and enterprises to invest in national defense, protects the legitimate rights and interests of investors and gives preferential policies according to law.

Article 57 Citizens and organizations have the right to make suggestions on national defense construction and to stop or report acts endangering national defense interests.

Article 58 Militia, reservists and other citizens shall perform their duties and obligations when they participate in military training according to law and undertake tasks such as combat readiness, defensive operations and non-war military operations. The state and society ensure that they enjoy corresponding treatment, and give them preferential treatment in accordance with relevant regulations.

Citizens and organizations that suffer direct economic losses due to national defense construction and military activities may receive compensation in accordance with relevant state regulations.

Chapter X Obligations and Rights and Interests of Soldiers

Fifty-ninth soldiers must be loyal to the motherland, loyal to the Communist Party of China (CPC), perform their duties, fight bravely, not afraid of sacrifice, and defend the security, honor and interests of the motherland.

Article 60 Soldiers must abide by the Constitution and laws in an exemplary manner, observe military regulations, execute orders and strictly observe discipline.

Article 61 Soldiers should carry forward the fine traditions of the people’s army, love and protect the people, take an active part in socialist modernization and complete tasks such as emergency rescue and disaster relief.

Article 62 Soldiers should be respected by the whole society.

The state establishes a military meritorious honor recognition system.

The state takes effective measures to protect the honor and personal dignity of military personnel, and provides special protection for the marriage of military personnel in accordance with the law.

The behavior of military personnel performing their duties according to law is protected by law.

Article 63 The state and society give preferential treatment to servicemen.

The state establishes a military treatment guarantee system that is compatible with military occupation and coordinated with the development of national economy.

Article 64 The state establishes a security system for retired military personnel, properly arranges retired military personnel and safeguards their legitimate rights and interests.

Article 65 The state and society give preferential treatment to disabled soldiers and give special protection to disabled soldiers’s life and medical care according to law.

After disabled soldiers, who was disabled or sick due to war or duty, retired from active service, the people’s governments at or above the county level shall promptly receive resettlement and ensure that his life is not lower than the local average living standard.

Article 66 The state and society give preferential treatment to families of servicemen, and give preferential treatment to families of martyrs and families of servicemen who died in the line of duty.

Chapter XI Foreign Military Relations

Article 67 People’s Republic of China (PRC) adheres to the five principles of mutual respect for sovereignty and territorial integrity, mutual non-aggression, non-interference in each other’s internal affairs, equality and mutual benefit, and peaceful coexistence, maintains the international system with the United Nations at the core and the international order based on international law, adheres to the concept of common, comprehensive, cooperative and sustainable security, promotes the building of a community of human destiny, independently handles foreign military relations, and conducts military exchanges and cooperation.

Article 68 People’s Republic of China (PRC) follows the basic norms of international relations based on the purposes and principles of the Charter of the United Nations, uses its armed forces in accordance with relevant national laws to protect the safety of citizens, organizations, institutions and facilities in China overseas, participates in United Nations peacekeeping, international rescue, maritime escort, joint training, combating terrorism and other activities, fulfills its international security obligations and safeguards the country’s overseas interests.

Article 69 People’s Republic of China (PRC) supports the military-related activities carried out by the international community that are conducive to maintaining world and regional peace, security and stability, supports the efforts made by the international community for the fair and reasonable settlement of international disputes and international arms control, disarmament and non-proliferation, participates in multilateral dialogue and negotiations in the security field, and promotes the formulation of universally accepted, fair and reasonable international rules.

Article 70 In its foreign military relations, People’s Republic of China (PRC) abides by relevant treaties and agreements concluded or acceded to with foreign countries and international organizations.

Chapter XII Supplementary Provisions

Article 71 The term "serviceman" as mentioned in this Law refers to officers, non-commissioned officers, conscripts and other personnel serving in the China People’s Liberation Army.

The provisions of this Law concerning soldiers shall apply to the People’s Armed Police.

Article 72 The defense of the People’s Republic of China (PRC) Special Administrative Region shall be stipulated by the Basic Law of the Special Administrative Region and relevant laws.

Article 73 This Law shall come into force as of January 1, 2021.