Vanke, the latest release

[Introduction] Vanke’s revenue in the first three quarters was nearly 219.9 billion yuan and 113,000 suites were delivered.

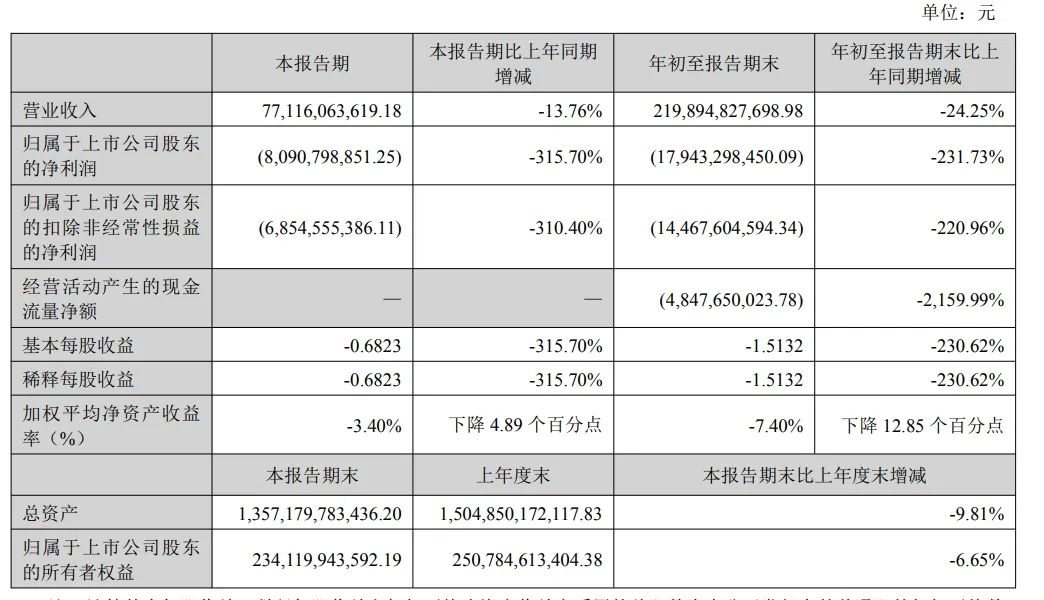

On the evening of October 30th, Vanke Enterprise Co., Ltd. (hereinafter referred to as Vanke) released its report for the third quarter of 2024. According to the third quarterly report, Vanke’s revenue in the first nine months was 219.89 billion yuan, and all public bonds were paid during the year.

Vanke’s revenue in the first nine months was 219.89 billion yuan.

The data shows that from January to September this year, Vanke’s accumulated operating income was 219.89 billion yuan; The net loss attributable to shareholders of listed companies was 17.94 billion yuan.

Among them, Vanke achieved operating income of 77.12 billion yuan in the third quarter; The net loss attributable to shareholders of listed companies is 8.09 billion yuan.

Regarding this performance loss, Vanke explained in the quarterly report that it was mainly due to the decline in the settlement scale and gross profit margin of development business, provision for impairment, some non-main financial investment losses, and the transaction price of some assets and equity was lower than the book value.

According to the announcement, from January to September, the gross profit margin of Vanke’s real estate development business was 8.3% before tax, 2.7% after deducting taxes and surcharges, 9.5% before tax and 4.9% after tax.

In fact, under the deep adjustment of the industry, the loss of housing enterprises is a common phenomenon, and the current first priority of housing enterprises is to ensure the safety of cash flow. According to the incomplete statistics in the semi-annual report period, over 60% of listed housing enterprises suffered losses, and the accumulated losses exceeded 100 billion yuan.

"In the case that the market scale has shrunk significantly in the past two years, full sales means trading at a price, and asset transactions have to be sold at a loss. The price of survival with a broken arm is often a big loss. In addition, the high-priced and restrictive land used in the high-speed development stage has further squeezed profits. Under the superposition of various factors, losses are more common. " A capital market person said.

All public bonds have been paid this year.

The third quarterly report shows that during the reporting period, Vanke continued to carry out its work around "guaranteeing the delivery of houses, guaranteeing payment, and transforming high-quality development".

In terms of delivery, in the first three quarters, Vanke completed the delivery of 113,000 suites on schedule with good quality, continued to promote the work of handing over certificates upon delivery, promoted property services in 51 large-scale projects, improved community business, transportation and education facilities, and created a community atmosphere. The increase in occupancy rate also promoted project sales.

It is understood that Vanke’s sales in the first three quarters exceeded 180 billion yuan, which outperformed the market. During the year, all new investment projects achieved 100% cash opening. Since 2023, the inventory capacity has exceeded 47 billion. After a series of policies were introduced at the end of September, Vanke also actively grasped market opportunities and achieved hot sales in many places.

It is understood that in recent years, Vanke has actively developed cutting-edge products that adapt to urban development trends, achieving hot sales in many first-tier and provincial capital cities, and its sales have remained at the forefront of the industry.

As a head housing enterprise, Vanke’s cash flow and financing situation have also received much attention from the market. In terms of public debt payment, in the third quarter, the Group achieved a net operating cash flow of 330 million yuan, which has remained positive since the second quarter.

According to the third quarterly report, as of the end of September, Vanke had completed the repayment of 19.7 billion yuan of public debt, and repaid about 70 billion yuan of interest-bearing debt in the first three quarters. There were no domestic and foreign public bonds due during the year.

Vanke said that during the reporting period, the Group took various measures to promote payment and ensure the smooth payment of public debts, including insisting on active sales, revitalizing existing resources, promoting bulk asset transactions and expanding asset withdrawal channels.

Among them, in terms of expanding asset exit channels, Vanke and CITIC and Taikang jointly established CITIC Vanke Consumer Infrastructure Pre-REIT Fund, and signed contracts for Shenzhen Longgang Vanke Plaza and Beijing Jiugong Vanke Plaza projects.

By the end of September, Vanke’s interest-bearing liabilities totaled 327.61 billion yuan, of which interest-bearing liabilities for more than one year accounted for 64.4%; The net debt ratio was 66.2%, and the asset-liability ratio excluding advance receipts was 65.4%, down 0.1 percentage point from the beginning of the year; The monetary funds held are 79.75 billion yuan.

On the whole, insiders pointed out that in the first three quarters of this year, in the face of the deep adjustment of the market, Vanke made full efforts to achieve both "guaranteed delivery" and "guaranteed payment".

The latest disclosure of the three main businesses

In April this year, Vanke proposed to focus on three main businesses: comprehensive residential development, property services and rental apartments. The latest third quarterly report also disclosed the status quo of these three main businesses.

According to the third quarterly report, in terms of real estate development, in the third quarter, Vanke achieved a contracted sales area of 3.913 million square meters and a contracted sales amount of 53.87 billion yuan, down 24.9% and 29.7% respectively.

In the first three quarters, Vanke achieved a total contracted sales area of 13.308 million square meters and contracted sales amount of 181.20 billion yuan, down 26.8% and 35.4% respectively.

Affected by favorable policies, the overall market activity increased during the 11th period. Vanke achieved good sales performance during the 11th holiday, achieving a subscription amount of 10.22 billion yuan, and the average daily subscription increased by 113% compared with the Mid-Autumn holiday. Among them, the conversion rate of visits in South China and Shanghai increased significantly, and the National Day subscription increased by more than 2 times compared with the Mid-Autumn holiday.

By the end of September, there were 19.616 million square meters of sold resources within the scope of Vanke’s consolidated statements, and the total contract amount was about 292.94 billion yuan.

In terms of property services, Vanke actively relies on service quality and brand advantages to expand high-quality projects, and continues to consolidate the quality of basic property services, and its smart property service capabilities are recognized.

According to the third quarterly report, in view of the listing of Wanwuyun on the Stock Exchange of Hong Kong Limited, detailed financial data on property services need to refer to its subsequent periodic reports.

In terms of renting apartments, the scale and efficiency of long-term rental apartment business remain the first in the industry. According to the announcement, in the first three quarters, Vanke’s rental housing business (including non-consolidated projects) achieved operating income of 2.63 billion yuan, a year-on-year increase of 3.7%. In the third quarter, Vanke’s "Park House" newly expanded 8641 houses and newly opened 4865 houses.

By the end of September, Boyu had operated and managed 247,000 long-term rental apartments, and opened 187,000 apartments, with a occupancy rate of 94.9%. In addition, Boyu actively responded to the national insurance policy, and 117,000 of the rented houses managed were included in the affordable rental housing.