The Bank of Japan suddenly raised interest rates.

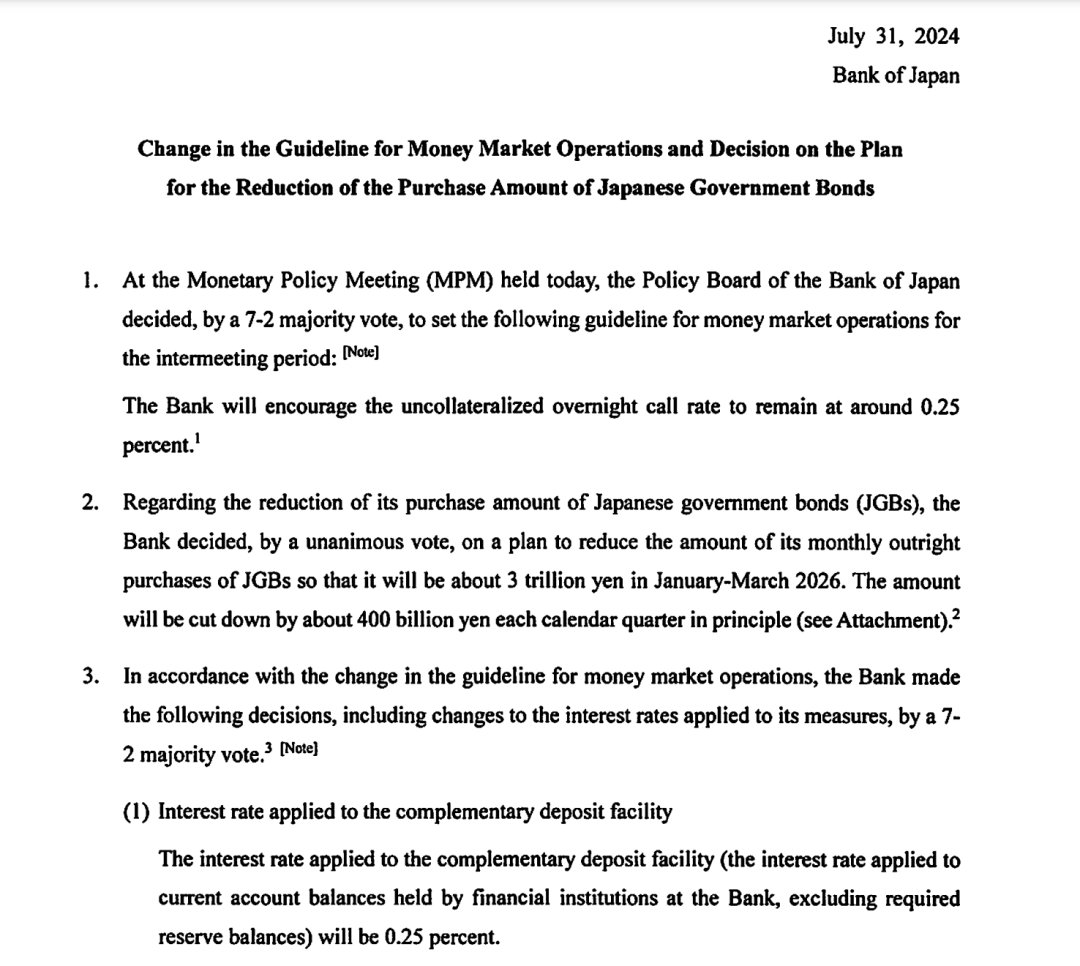

On July 31, local time, the Bank of Japan suddenly announced a rate hike, adjusting the current policy interest rate of 0% to 0.1% to around 0.25%. This is also the first rate hike since the Bank of Japan lifted its negative interest rate policy in March this year.

At the same time, the Bank of Japan announced a detailed table reduction plan. The scale of government bond purchases will be reduced by 400 billion yen every quarter, and the monthly bond purchases from January to March 2026 will be about 3 trillion yen. Although the plan is generally in line with expectations, the reduction in bond purchases is lower than market expectations.

Under the "double impact" of raising interest rates and shrinking the table, the exchange rate of the US dollar against the Japanese yen suffered a short-term earthquake, once breaking through the 152 mark. As of press time, the exchange rate of the US dollar against the Japanese yen was reported at 152.1.

As of the close of July 31, the Nikkei 225 index closed up 1.49% at 39,101.82 points. The yield of Japanese five-year government bonds rose by 7.5 basis points to 0.660%, the highest level since November 2009.

Analysts believe that the Bank of Japan cut its bond purchases while raising interest rates, demonstrating its determination to normalize its policies. The Bank of Japan also hinted in its statement that it may continue to tighten monetary policy in the future. "The future monetary policy operation will depend on the future development of economic activities, prices and financial conditions. However, given that the real interest rate is at a significantly low level, if the prospects put forward in the outlook report in July can be realized, the central bank will continue to raise the policy interest rate accordingly and adjust the degree of monetary easing."

On July 31, Bank of Japan Governor Kazuo Ueda said that it is appropriate to adjust the easing policy from the perspective of achieving the sustainability and stability of 2% inflation. The real interest rate may still be significantly negative, and the relaxed financial environment will continue to support the economy. If the current economic and price prospects are realized, we will continue to raise interest rates and adjust the intensity of easing policies.

Since the negative interest rate policy was lifted in March this year, the Bank of Japan has been cautious in raising interest rates. What are the considerations for raising interest rates at this time?

Justin Hu, a professor of practice at Shanghai Institute of Advanced Finance, Shanghai Jiaotong University, told reporters that the certainty of Japan’s deflation is gradually stabilizing. Since April 2022, Japan’s CPI has been consistently higher than the central bank’s target of 2% year-on-year. At the same time, the recent weakness of the yen has also prompted the Bank of Japan to raise interest rates to some extent.

In the summary of its latest outlook report, the Bank of Japan also showed optimism about the sustainability of inflation. The Bank of Japan lowered the median core CPI forecast for FY 2024 to 2.5%, and raised the median core CPI forecast for FY 2025 to 2.1%.

The Foreign Exchange Group of the Research Department of CICC believes that the Bank of Japan’s interest rate hike may also be considered by the United States to cut interest rates. At present, the market has fully priced the Federal Reserve’s interest rate cut in September. Under this background, if the Bank of Japan postpones the interest rate hike to the meeting in September or October, it will highlight the hawkish behavior of the Bank of Japan and the convergence of US and Japanese monetary policies, which may further bring about the appreciation of the yen and the upward trend of Japanese bond interest rates.