From triumphant progress to difficult steps, how far can Five Questions Huimin Bao go?

Text | Shen Zhipeng

June 30, 2022

Qingdao "Qindao E-insurance" has 1.61 million participants, 76.3% of the same period last year. "Qindao E-insurance" announced that the insurance period would be extended by 20 days, and the insurance period for residents would end at 24: 00 on July 20th.

July 31, 2022

The number of Shanghai "Huhuibao" participants was 6.45 million, which was 87.27% of the same period last year. The insurance period of Huhuibao is extended by 20 days, and the premium and guarantee period remain unchanged.

In 2022

Weihai’s "Wei Ni Bao" enrollment progress is far lower than the same period last year.

These different names of insurance have a common name-"Huimin Insurance". With the new payment cycle of Huimin Insurance in various places, people find that the enthusiasm of customers is rapidly declining, and the participation data is declining instead of increasing.

Is it a customer change of heart or a product failure? There is a heated discussion in the industry about what happened to Huimin Bao, wondering whether such products can go on.

Some people blame this situation on the "death spiral" of insurance, and think that adverse selection is the main reason.

Specific to Huimin insurance, it is its low premium and high security ability, which lies in the sharing of medical expenses between healthy people and patients with previous diseases.

When the participation rate is high enough and there are enough healthy people who can share the medical costs of people with previous illnesses, Huimin insurance will continue;

Once the participation rate of healthy people is insufficient, and the proportion of people suffering from serious diseases in the insured population is gradually increasing, the overall product will enter a "death spiral", which will be unsustainable.

In fact, in addition to the "death spiral", Huimin Insurance entering 2022 is still facing multiple severe tests, and more deep problems are emerging one by one.

one

-Insurance Today-

Huimin Bao "triangle model"

Different parties have different perspectives and different demands.

Many people regard 2015 and Shenzhen as the starting time and starting place of Huimin insurance products, but it is not. The real Huimin insurance products began in 2020.

In 2015, Shenzhen Special Economic Zone took the lead in implementing supplementary insurance for serious illness, which has experienced years of running-in and stable operation.

In 2020, the Opinions of the Central Committee of the Communist Party of China and the State Council on Deepening the Reform of the Medical Security System (Zhongfa [2020] No.5) was promulgated, pointing out that:

"By 2030, a medical security system with basic medical insurance as the main body, medical assistance as the backing, supplementary medical insurance, commercial health insurance, charitable donations and medical mutual assistance will be fully established."

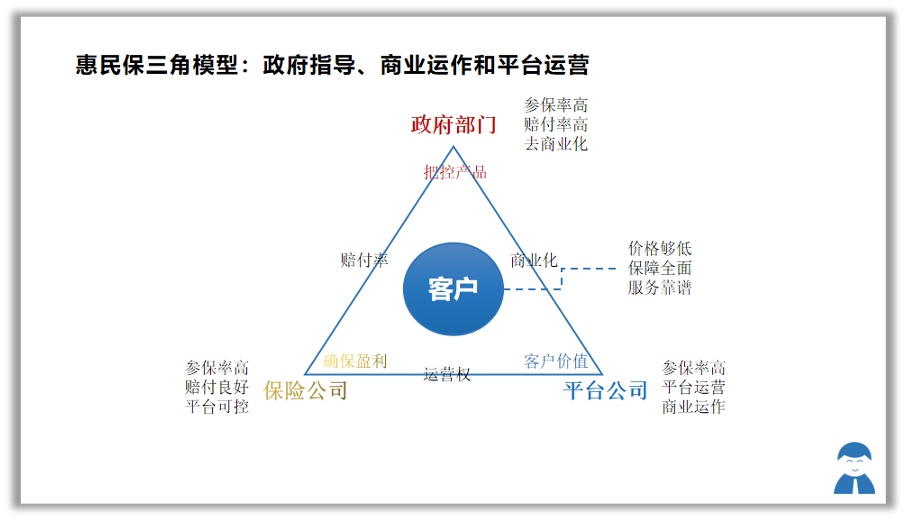

Huimin insurance is the product of the in-depth development of national medical insurance reform, and this document is the guiding document for all Huimin insurance products in the market. The nature of Huimin insurance is between basic medical insurance and commercial insurance. With the help of the third-party platform, Huimin insurance has developed rapidly, forming a triangular model of "government guidance, commercial operation and platform operation".

Due to the different perspectives of the government, insurance companies and platforms, apart from the common expectation of the participation rate, there are many differences in demands among the three parties, even for the insured users and the Huimin insurance project itself. This leads to a series of problems that affect the development of Huimin insurance.

2

-Insurance Today-

The first question

It is difficult to balance "government guidance" and "commercial operation"

2022 is the second year of many Huimin insurance projects. Because payout ratio was lower than expected in the first year, as a government-directed project, government departments were under great pressure from public opinion.

In this context, many regional medical insurance departments have put forward clear requirements for insurance companies. In fact, it is also understandable that an insurance project with a "quasi-policy" color endorsed by the government’s credibility for insurance companies can never sit idly by and watch commercial insurance companies earn a lot of money. However, for insurance companies, there are also pressures. On the one hand, health insurance has the characteristics of lagging claims, and some claims have not been paid yet; On the other hand, the project itself has to face the company’s profit assessment.

So, how to balance the two demands? This balance point is difficult to grasp. If the balance is not good, either the government’s support for the project will weaken or the insurance company will lose enthusiasm for the project. No matter which side weakens or withdraws, it will bring uncertainty, which is not conducive to the sustained and healthy development of Huimin Insurance.

For fear of over-commercialization, government-guided projects will prohibit excessive pursuit of profits and insurance companies from providing insurance products or services other than Huimin Insurance. This has brought great pressure to the Huimin insurance project. From the essence of business, the government-guided Huimin insurance project is more like a group policy in which the government as the insured and the insured voluntarily pay. With the advantage of number and scale, government departments have absolute bargaining power and dominance over insurance companies, which leads to such projects being meager, flat or even losing money. From the perspective of sustainable development of Huimin insurance, it is necessary to have commercial means and methods, otherwise, only operating a single Huimin insurance product will not enrich the product structure and increase the scale of operating income, and such projects will not form a business model.

Compared with the claim rate requirement, the government’s request for commercialization has a greater impact on the development of Huimin Insurance. Perhaps this is also one of the important reasons why Shenzhen’s serious illness supplementary insurance first emerged, but it was not copied externally.

three

-Insurance Today-

the second question

Two types of insurance companies, property insurance and life insurance, need to be improved and involved in each other.

At present, the main participants of Huimin Insurance are property insurance companies. The main reason is that property insurance companies are affected by the auto insurance reform, and they are very concerned about short-term health insurance premiums. With the help of the government business experience of property insurance companies, they quickly enter Huimin Insurance Circuit and grab a favorable position.

Compared with life insurance company’s complete life insurance product sequence, professional life insurance service ability and powerful service network, property insurance company has some inherent shortcomings, so it is necessary to continuously strengthen the professional strength of service and products, change the business thinking of auto insurance in the past, and realize long-term benefits through continuous operation and demand mining for customers.

In the early stage, life insurance companies participated in a small number of projects, and even if they participated, they only acted as co-insurance companies. The main reason was that life insurance companies focused on long-term insurance. In the last two years, the growth of long-term insurance premiums was hindered and the agent team dropped off. In addition, life insurance companies did not participate much in government-run projects before, which led to the initial lack of time for life insurance companies to quickly join Huimin Insurance Circuit.

Next, life insurance companies need to solve the relationship between Huimin insurance business and its team development and long-term insurance business. Life insurance teams and agents need to integrate Huimin insurance with their own business in order to stimulate life insurance potential and give play to their advantages.

Whether property insurance companies or life insurance companies do a good job in Huimin insurance business, they all need a joint platform company to continuously serve the growing and changing needs of customers through the combination of online empowerment and offline services, establish a stable customer relationship and a good service experience, and firmly lay the foundation for the long-term and stable development of Huimin insurance.

four

-Insurance Today-

Third question

The expectation of comprehensive protection and the reality of only covering serious illness

As an entry-level health insurance, Huimin Insurance has quickly completed the insurance education for the public, which is mainly due to the urgent protection needs of ordinary people (603883).

Today, with the development of society, we still see all kinds of information about fund-raising due to illness, which shows that there is still a cruel reality that many people in this society have not received corresponding protection, especially for low-and middle-income groups and underdeveloped areas, the breadth and depth of commercial insurance are far from what it should be.

It’s not that ordinary people don’t want to buy insurance, but there are practical problems. The first is the issue of trust, the second is that the price is too expensive, and the third is the threshold limit for participation.

It can be said that Huimin Insurance has solved the above problems well and even become the first commercial health insurance for many urban white-collar workers. It’s like people have to buy a full insurance after buying a car. Although they don’t know much about the specific content of full insurance, there are usually misunderstandings, thinking that all cars can be compensated for their accidents. Ordinary people buy Huimin Insurance and think that it can provide all medical insurance.

In fact, Huimin insurance is only a supplementary insurance for serious illness, and there are conditions such as higher deductible, which can not only solve most of the problems of most people, but also meet certain conditions for solving the problems of a few people.

In this way, there is an irreconcilable contradiction between the people’s comprehensive security needs and high psychological expectations and the limited security of Huimin insurance.

This year, there have been many voices questioning Huimin Insurance on the Internet, which even became a hot topic in local search. Everyone discussed "benefiting the people to protect the people", and there was a community of "* * * revealing the scam of benefiting the people".

This is usually because ordinary people do not pay attention to the details of the terms when they are insured. When they actually claim compensation, they find that the deductible is high and there are many restrictions on the scope of reimbursement, which will inevitably lead to emotional rebound. If the relevant parties do not provide good service and explain communication, they will easily escalate into negative public opinion.

The problem of benefiting the people and protecting public opinion has become a problem in many places, even in cities with high claims rate. After all, the real benefit is only those who are seriously ill and spend a lot of money.

These people are only a small part of all the insured. For most insured people, there is no benefit and no sense of gain.

For ordinary people, what they need is comprehensive protection and services, not only individuals but also families, which contain a lot of medical care and related content.

For example, there are children in the family who have bad teeth and are prone to problems, so there is a need for oral health care and protection; There are elderly people at home, medical needs or medication needs, and there will also be unexpected protection needs; For families, there are financial needs at the beginning or end of the month.

All these are not supported by a Huimin insurance, but need a Huimin security system, which not only solves the serious illness problem, but also solves the medical and health service needs, and also solves the mental health or financial health needs of families and individuals. From this perspective, Huimin Bao is only the first step.

five

-Insurance Today-

The fourth question

The operation platform is awkward.

At first, the platform company was the promoter of the rapid development of Huimin Insurance.

Some platform companies with mature experience and talent teams have helped insurance companies with political insurance experience or government resources to achieve a "zero to one" quick cold start. At one time, platform companies led or influenced the development of the project. However, with the increase in the number of platform companies and the increasing dominance of government departments, platform companies first came to an embarrassing situation.

There is even a fierce price killing between platforms. In this way, the platform’s own value and significance of existence have been completely abandoned. The platform itself should be based on operational services and technology empowerment to make money, but the result is to enter the market at the expense of "white-edged fighting" to the end. Moreover, in the actual operation process, the operation platform is doing the implementation work, but it is not allowed to do any commercialization or customer operation.

Some people even suggest that insurance companies can operate, but objectively speaking, the organizational structure and operating mechanism of insurance companies are traditional rules, and platform operation requires long-term investment of funds and teams, service integration and product innovation, and rapid and flexible response mechanisms, which are not what insurance companies can do.

In the actual project operation, limited by the commercialization of the government and the insurance company’s right to operate, it is difficult for platform companies to have the opportunity to try and innovate. This is also one of the main obstacles to Huimin’s innovation and development.

six

-Insurance Today-

The fifth question

To be or not to be?

Since there are so many deep-seated problems, some people worry that Huimin Bao will disappear soon.

I believe that Huiminbao will survive.

Huimin insurance "comes from time to time, thrives on demand, and changes according to the situation", which includes the arrangement of top-level design for people’s livelihood security, the rigid demand of promoting people’s livelihood, and the changes of times, insurance reform and industrial integration. Although there are many problems in the process of development, although some problems are unsolvable in a short time, there is reason to believe that time and development will break through each problem one by one.

From another angle, the security needs of ordinary people are there. If there is no Huimin insurance, is there a better alternative? Will other alternatives solve the current contradictions and problems? After substitution, can it bring greater industry development and social benefits? While thinking, let’s review the innovations and surprises in the development process of Huimin Insurance.

May 2020

Beijing Jinghuibao Project Team launched "Huitabao", the exclusive inclusive guarantee for women, which extended to specific groups on the basis of serious illness, and broadened the scope and services of reimbursement for specific diseases on the basis of continuing the price to benefit the people. "Huitabao" became the masterpiece of the first Pratt & Whitney series products.

September 2021

Zibo launched the service of "Qi Huibao+public welfare assistance". By June 2022, the special public welfare fund for rare diseases in Zibo had served 3 patients with spinal muscular dystrophy (SMA). After serious illness insurance, Qi Huibao reimbursement and public welfare fund assistance, the out-of-pocket expenses of patients were reduced to less than 30%, effectively reducing the economic burden of patients and their families. Huimin insurance+public welfare fund better embodies the concept and significance of multi-level protection.

November 2021

Guangzhou "Sui Sui Kang" has expanded the scope of the insured population. On the basis of social medical insurance participants in Guangzhou and other medical security personnel in Guangzhou in 2021, Sui Sui Kang has added three categories of participants: first, registered residents in Guangzhou, second, those who have applied for and held the Guangdong Residence Permit in Guangzhou and have been registered for two consecutive years, and third, those who have been recognized by the relevant departments of Guangzhou as courageous in the administrative area of Guangzhou, basically achieving full coverage of the permanent population in Guangzhou. Absorb new citizens to participate in the insurance, so that the benefits of Huimin Bao Pratt & Whitney will be more deeply rooted in the hearts of the people.

A small step in the development of Huimin insurance is a big step in the health insurance industry. From the unimaginable a few years ago to the rapid development in the last two years, although there are difficulties, we will certainly be able to step over the bumps.

We look forward to the early formation of the commercial closed loop of Huimin Insurance, which will bring new possibilities and choices for the transformation of the insurance industry and provide customers with more complete protection and services.

This article was first published on WeChat WeChat official account: Today’s Insurance. The content of the article belongs to the author’s personal opinion and does not represent Hexun.com’s position. Investors should operate accordingly, at their own risk.